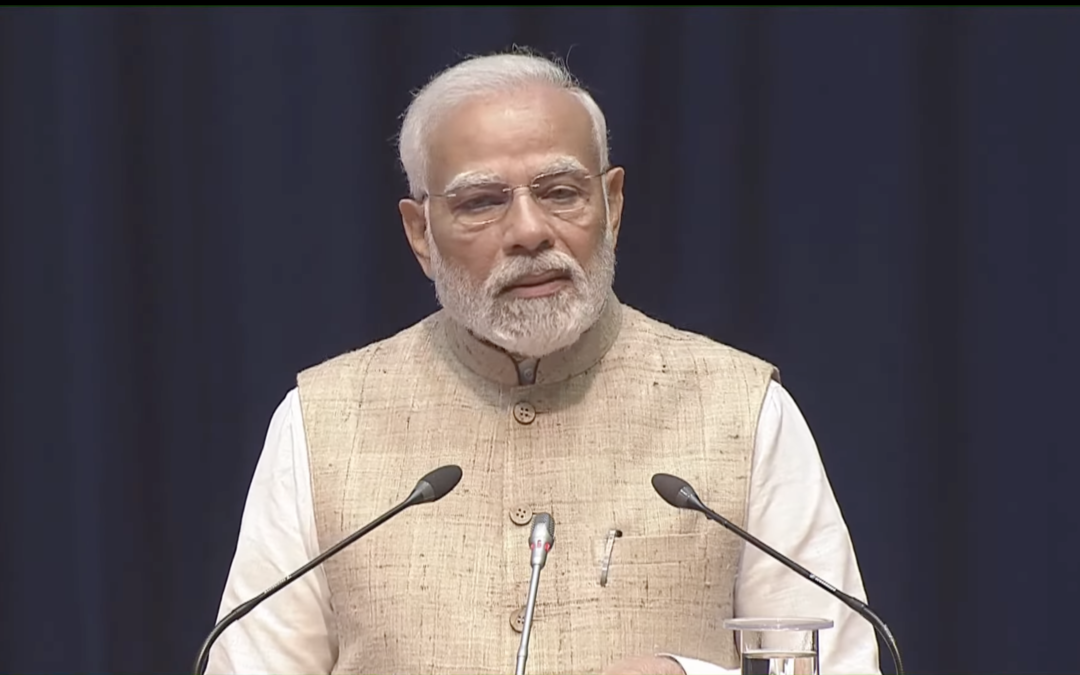

Prime Minister Narendra Modi

Addressing the Global Fintech Fest 2024 in Mumbai, the Prime Minister also asked the regulators to take more measures to stop cyber frauds and further increase digital literacy among people.The Prime Minister also said that in the last 10 years, the fintech space has attracted investments of more than USD 31 billion and fintech startups have grown by 500 per cent

Mumbai: Prime Minister Narendra Modi on Friday said the government is taking various measures at the policy level to promote the fintech sector, which attracted over USD 31 billion investments in the last 10 years, and the abolition of the Angel Tax is also a step towards the growth of the segment.

Addressing the Global Fintech Fest 2024 here, the Prime Minister also asked the regulators to take more measures to stop cyber frauds and further increase digital literacy among people.

“Fintech has played a significant role in democratising financial services,” he said, and expressed confidence that it will help in improving the quality of life for Indians.

Modi emphasised that adoption of fintech by Indians is “unmatched in speed and scale” and no such example can be found anywhere else in the world.

He said the transformation brought about by the fintech sector in India is not just limited to technology, but its social impact is far-reaching.

He also stressed that fintech has dented the parallel economy and is bridging the gap between villages and cities on the financial services front.

The Prime Minister also said that in the last 10 years, the fintech space has attracted investments of more than USD 31 billion and fintech startups have grown by 500 per cent.

He said it is festive season in India, there is also festivity in the economy and markets, in an apparent reference to the robust GDP growth and capital market scaling new highs.

Modi also informed the gathering that loans worth over Rs 27 lakh crore have been disbursed under the Pradhan Mantri MUDRA Yojana, world’s largest microfinance scheme.

Speaking at the event, RBI Governor Shaktikanta Das said, digital technologies have been instrumental in expanding financial inclusion, improving efficiency and enabling real time services across the country.

“Today, India stands as a global leader in digital payments, a feat achieved by combining proactive policy making with innovation and technological advancements. Collaboration between policy makers, regulators and innovators is the defining element of India’s Fintech journey,” Das said.

The Reserve Bank’s regulatory frameworks have facilitated new and innovative businesses to grow in an orderly manner, he said.

“These regulatory initiatives reflect our commitment to support innovation with prudence. Our collaborative approach is visible in the fact that we have held a large number of interactions over the last one year with the Fintech sector players,” he said.