As part of the affiliation, HDFC Pension will manage pension...

Category:

Pension & Social Security

Latest

PFRDA constitutes 9-member panel to review and modernise NPS investment framework

It will benchmark these norms against global pension systems and...

PFRDA constitutes high-level committee to overhaul NPS payouts

According to the Finance Ministry, the committee is established as...

Consider govt employee’s plea to include live-in partner in family pension: Delhi HC to Centre

A bench of Justices Navin Chawla and Madhu Jain held that the petitioner government employee never concealed his relationship, and treating his efforts to include the names of his partner and children as his family as "grave misconduct" to deny post-retirement...

Labour Ministry proposes 90-day annual work threshold for gig worker social security

It explained that a gig worker, or a platform worker, will be considered to be engaged with an aggregator for one day if they have earned income, irrespective of the amount, for such work rendered with the aggregator on that calendar day. New Delhi: The Labour...

Economic Reforms Agenda-2025: Simplifying regulations, and strengthening social security

Labour reforms form another cornerstone of the 2025 agenda. The government has consolidated 29 labour laws into four Labour Codes covering wages, industrial relations, social security and occupational safety. The new framework extends social security benefits to...

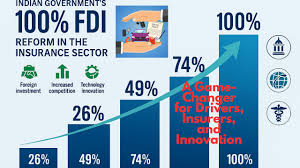

100% FDI in Insurance:India’s big-bang financial reforms target wave of foreign money

All these reforms come as Prime Minister Narendra Modi and his administration want to make India a developed economy by 2047,a goal that requires economic growth of about 8% per year, and policymakers are betting on rapid industrialization and deeper capital markets...

Along with insurers,100% FDI to be allowed for Pension Fund players

The measure for Indian insurers is an “enabler” that will help draw interest from global investors in the pension fund sector over time, said Sivasubramanian Ramann, chairman of the Pension Fund Regulatory and Development Authority New Delhi: India’s move to lift...

NPS exit rules for non-govt subscribers eased to allow up to 80 pc lump sum withdrawals

Under the revised framework for corpus exceeding Rs 12 lakh, the new rule is shifted to 80:20, allowing non-government subscribers to take up to 80 per cent as a lump sum while requiring only 20 per cent of the pension wealth to be used for purchasing an annuity,...

PFRDA widens investment options for funds

The PFRDA will now allow private pension funds to invest in the top 250 stocks by market capitalisation listed on India's bourses. Earlier, these funds were allowed to invest in a list of 200 stocks approved by the trust of the National Pension Scheme New...

New labour codes give gig, platform workers portable social security benefits

Under the Social Security code, aggregators are now required to contribute 1–2 per cent of annual turnover, capped at 5 per cent of payments made or payable to gig and platform workers to a Social Security Fund, an official statement said.The fund finances a range of...

Over 50 lakh Central government employees and nearly 69 lakh pensioners to gain from 8th Central Pay Commission

The Centre currently employs 50.14 lakh personnel, while pensioners number around 69 lakh, all of whom fall under the purview of the upcoming pay revision exercise, Minister of State for Finance, Pankaj Chaudhary, told the Lok Sabha in a written reply to questions...

Social security coverage rises to 64% from 19% in 2014: Mansukh Mandaviya

Labour and Employment Minister Mansukh Mandaviya noted that 94 crore people in the country are currently covered under accident, health and pension benefits, placing India just behind China, which covers 107 crore people New Delhi: India has expanded social security...