Indian

Cut costs, fix mis-selling to make insurance products affordable: IRDAI member to insurers

"The high cost of acquisition and high expenses of management (EoM)...

Guj HC issues notices to Central and state govts on PIL flagging AI misuse for deepfake content

The petitioner requested the high court’s directions to authorities...

Don’t view all organ donors with scepticism, says HC; directs DME to permit transplant

"It's not to be forgotten that some compassionate individuals are...

Over 1,000 construction sites in Mumbai served stop-work notices: Minister

“We are following a strict escalation matrix for violators....

International

Marsh exploring selling its financial risk manager and life insurance broker for high-net-worth individuals in Asia

PCS provides financial risk management and life insurance services...

Ecuador contracts first parametric insurance for 10k climate-vulnerable farmers, with Germany, UNDP, ISF and IDF support

The two parametric products — for extreme rainfall and drought-risk...

AIA Australia deploys SCOR’s VClaims

Tracey Crowe, General Manager for Claims and Underwriting at AIA...

UIB partners with CyberCube to accelerate its growth across LATAM and Asia

Dimaggio Rigby, Head of Cyber at UIB, added,“The cyber landscape is...

Briefs

TATA AIG launches Personal Accident policy

TATA AIG General Insurance today announced the launch of Accident...

Lockton in partnership with AdvantageClub.ai lauches employee wellbeing solution in India

Re/Insurance broker Lockton in partnership with AdvantageClub.ai,...

Events

3rd edition “IFSCA-IRDAI GIFT-City Global Reinsurance Summit on Jan 19, 2026 in Mumbai

The 3rd edition “IFSCA-IRDAI GIFT-City Global Reinsurance Summit”...

IIA Annual Event 2025

Date: October 30, 2025 Venue: Fairmont, Mumbai Theme: AI In...

Advertisement

Articles

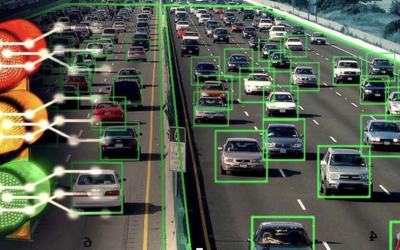

From chaos to coaching: How real-time AI is slashing road fatalities on Indian roads

While global conversations often centre on AI's role in automation...

India:Rich citizens live in cities with poor conditions

Last week’s budget made a song and dance about various new grants...

Japan:Businesses navigating rapidly changing market and geopolitical volatility

Tatsuya Yamamoto, CEO of Japan at Aon, said, “Japanese...

Features

Data

Interviews

“Competition in the group health insurance segment is intense”

Nilanjan Roy, Head of Group Business, ManipalCigna Health...

“IndiaFirst Life is progressively becoming a multi-channel distribution player in the industry.”

Varun Gupta, President & Chief Distribution Officer (CDO) –...

Facts

Finmin launches Paripoorna Mediclaim Ayush Bima for CGHS beneficiaries

The policy provides indemnity-based in-patient hospitalisation coverage within India, with sum insured options of Rs 10 lakh or Rs 20 lakh.To be provided by state-run New India Assurance, the other features include that the room rent is capped at 1 per cent and 2 per...

Elon Musk predicts working will become “Optional” like a hobby within 20 years as AI advances rapidly

Musk explained that with accelerating progress in AI and robotics, people may reach a stage where they can choose whether to work or not, similar to choosing whether to grow vegetables at home despite having the option to buy them from a store Washington: Tesla CEO...

Flying car, four-wheeled robot shine at Nepal auto show

Deepal’s eVTOL (electric Vertical Take-Off and Landing) UAV, a flying car manufactured in China and Unitree Robots’ advanced four-wheeled robot are the main attractions in the 17th edition of NADA Auto Show. Kathmandu: In a first, a flying car and four wheeled robot...

AI in India:20 jobs likely to be affected — and 20 that may stay safe

Jobs that will be most affected by AI: Ticket agents/travel clerks,legal assistants (routine drafting),Telephone operators,Finance/insurance underwriters doing rote tasks,Coders doing repetitive tasks,Junior marketing researchers,Customer service representatives,Basic...

Study finds climate change could worsen risk of diarrhoea among children in South, Southeast Asia

The findings, published in the journal Environmental Research, also highlight temperature extremes and declining rainfall (in a year's wettest month) as the two main climate-associated factors driving a higher risk of diarrhoea among children. Climate change could...