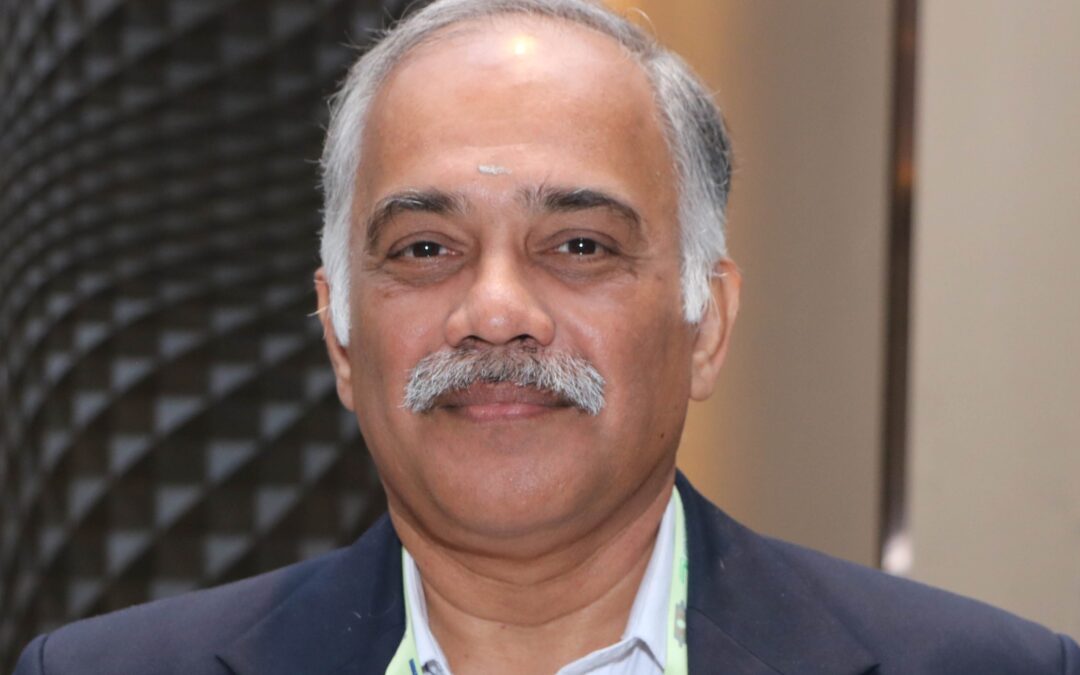

Nilanjan Roy, Head of Group Business, ManipalCigna Health...

Category:

Interviews

Latest

“IndiaFirst Life is progressively becoming a multi-channel distribution player in the industry.”

Varun Gupta, President & Chief Distribution Officer (CDO) –...

“For Munich Re, it is of utmost importance that rates and conditions are risk-adequate to insure sustainability of the business”

With the beginning of the renewal season in Asian region, Hitesh...

“Acquisitions in India remain an option if a compelling opportunity arises aligning with our long-term vision”

Laurent Rousseau, CEO of Europe, IMEA and Global Capital Solutions, Guy Carpenter 33% of the overall Indiancapacity (premium) is still provided by cross boarder reinsurers(CBRs). CBRs play a critical role particularly in specialty lines (e.g. Terrorism,...

“Reinsurance capacities in India may be required only for property, agri and specialty lines like aviation & cyber”

N Ramaswamy, CMD, GIC Re The effort from the Regulator is to create a more conducive environment for doing business as well as to attract more players to set up shop in India. The Indian market is in a stage of big growth and it will need huge capital resources from...

“NSDC is looking to expand its involvement in the Indian Insurance sector”

Ved Mani Tiwari, CEO, National Skill Development Development Council National Skill Development Corporation (NSDC), set up by Ministry of Finance as Public Private Partnership (PPP) model, acts as a catalyst in skill development by providing funding to enterprises,...

“For those businesses that are proactively investing in cybersecurity measures, we expect prices to remain stable”

In an exclusive interview with Asia Insurance Post, Teck Siong Ng, Underwriter, Cyber & Technology, Beazley speaks about the latest trends in Asia’s cyber insurance market and outlines his company's strategies to grow its business in the regionEdited Excerpts:...

“We are likely to come out with a set of pension regulations soon”

Gujarat International Finance Tec-City, India’s newest financial hub and a flagship project of Prime Minister Narendra Modi, is preparing for its next phase of growth. The first phase followed the creation in 2020 of a new regulator, the International Financial...

“Our aim is profitability. We aspire to be among the top performing global reinsurers”

In an exclusive interview with Asia Insurance Post, on the occasion of Rendezvous September, Monte Carlo, Devesh Srivastava, CMD, GIC Re highlights major achievements during his 4-year tenure as the head of the third largest Asian reinsurer. The period of...

“There is an urgent need to lower the premium rates, and making the PMFBY fiscally sustainable”

Girija Kumar, chairman and managing director, Agriculture Insurance Company, in an interview with Asia Insurance Post, explains how USD $ 4 billion Indian Crop Insurance market(FY 2022-23) will expand faster going ahead How do you see Indian crop insurance market? The...

“Munich Re is committed to support Indian insurance industry, to bring in new products and solutions to the market’’

Growing its business fast, Munich Re, the largest global reinsurer,has emerged as one of the key Foreign Reinsurance Branche(FRB) in India. Hitesh Kotak, Chief Executive, India, Middle East and Africa, Munich Re,in an interview with Asia Insurance Post, outlines his...

“Today, we are in a position to service more than 60% of our policyholders entirely digitally”

Krishnan Ramachandran,MD and CEO, Niva Bupa Health Insurance Niva Bupa Health Insurance Company has invested in building digital expertise across the entire value chain and be it onboarding customers or settling claims, everything is digital. The company is using new...

`Bima Sugam is a big game changer for the end user and companies will also get the advantage”

In an interview with IANS, Anil Kumar Aggarwal, Managing Director & CEO, Shriram General Insurance Company, said the year 2022 has been one of the best years for the Indian general insurance industry. As per the trends, the industry is expected to double its...