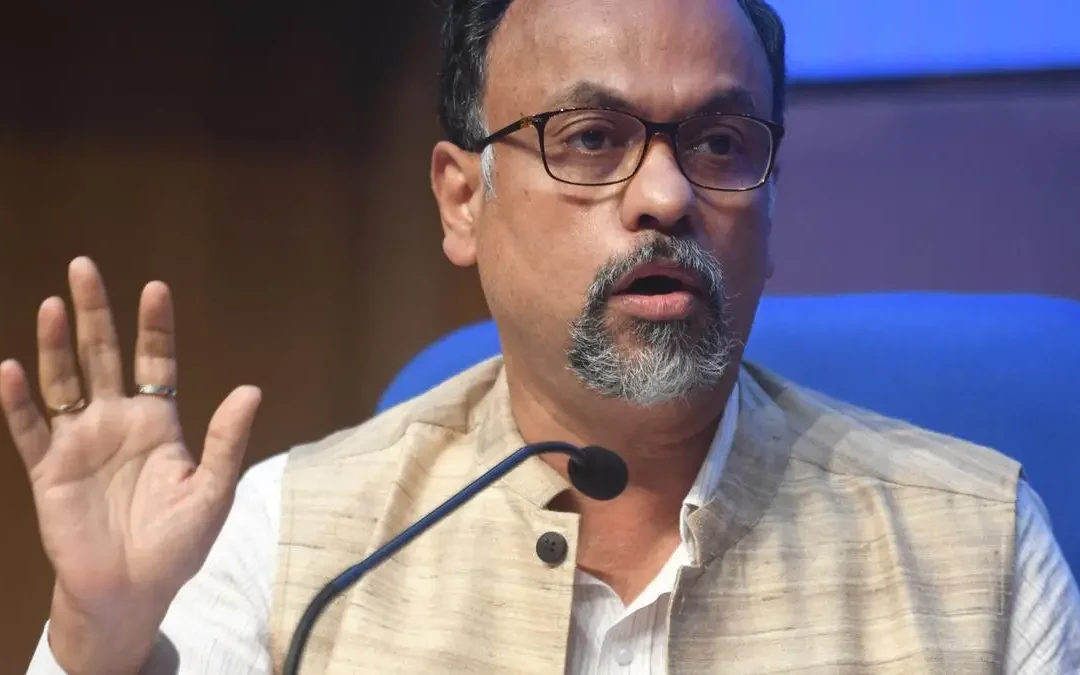

Debasish Panda,chairman,IRDAI

The IRDAI, on Feb 12, is expected to do a plain speaking to the insurers who have not taken their Bima Sugam job seriously.

IRDAI chairman Debasish Panda will address CEOs of non-life insurance companies on 13th Feb and life companies next day

Hyderabad: Insurance regulator IRDAI has summoned CEOs of the Indian insurance companies on 12 Feb to Hyderabad to sort out issues faced by its game changing move, Bima Sugam, which will be followed by two days of Bima Manthan, the last one for FY 25.

IRDAI chairman Debasish Panda will address CEOs of non-life insurance companies on 13th Feb and life companies next day.

Bima Sugam, the electronic market place, which is expected to transform the way retail insurance business is done, of late, is facing financial issues and unable to take off as planned originally.

Earlier, the project, part of Bima Trinity, to achieve Insurance For all by 2047, was expected to go live by the IRDA’s foundation day-Apr 19 .

Bima Trinity includes benefit-based product Bima Vistaar, localised women-centric insurance field/sales force Bima Vaahak and Bima Sugam.

Though, a great deal has been talked about all the three innovative, high-tech initiatives, nothing has taken off fully as yet, said industry observers.

Though, the Bima Sugam India Federation, a non-profit company, which will be undertaking and managing the high-tech platform, has already appointed a chief executive officer (CEO), chief financial officer(CFO) and chief technology officer(CTO), the project is unable to progress as it hasn’t got the total initial funding from the industry as yet to take care of its initial investment and expenses.

The Indian insurance industry is supposed to provide almost Rs 200 crore as the seed capital to kick start the project.

However, almost 15 insures including some big, small players and PSUs, haven’t yet put up the proposal for their board approvals to pay their share of the capital.

The IRDAI, on Feb 12, is expected to do a plain speaking to the insurers who have not taken their Bima Sugam job seriously.

Bima Vistaar,an all-in-one policy providing life, health, accident, and property coverage for, addressing the insurance needs of India’s rural population. is also delayed as a lot of technical issues are yet to be tied up, said IRDAI sources.

Though, the annual premium for Bima Vistaar has already been decided- Rs 1,500 per individual and Rs 2,420 per family- other aspects like bundling of the product, the distributing agency to reach out 2,500 panchayats and how a claim will be settled in such a bundled product, are yet to be put in place.

The two-day Bima Manthan will also discuss issues relating IRDAI’s plan for state insurance and unfinished agenda of Risk Based Capital (RBC) and International Financial Reporting Standards (IFRS).

Few insurers have decreased agency commission by 1/3 for renewal premium for Health insurance above 50 years of age. Those people pay more premium and due to sudden increase of 30 to 40 % are forced to pay a huge amount of premium. For my personal health insurance policy, for a sum assured amount of Rs.2 lakhs I have to pay Rs.63,305.82 Why IRDAI doesn’t take care of this? How can I pay this amount. I have to borrow. PMJAY card is also not dowloadable.

If it is delivered at home like Aadhaar card, it will be helpful for senior citizens like me. We feel neglected.

For renewal, migration and port after 60 months no questions on pre existing disease must be asked during renewals. The use of this norm is being used by some health insurance companies as an excuse to deny claims.

I request the IRDAI Chairman to fix this issue.

I have to ask what is the maximum time Bima lokpal takes for settlement of complaint? As we had sent complaint against claim rejection by a Health Insurance Co. some 16 months back. But nothing has been done so far.

IRDAI has published Circular on 30th January 2025 instructing insurance Companies not to increase premium for Senior Citizens by more than 10% , but companies are not following it, saying that premium is revised before this Circular. What action IRDAI will take for this?

IRDAI must check and increase the Bonus given to policy holder

From 20 years and above to

Rs 50/- thousand per year.

From 25 years and above to

Rs 55/- thousand per year

&

From 30years and above to

Rs 60/- thousand per years.

Some of the unethical practices commonly adopted by insurance companies are —arbitrary claim rejections to the misuse of vague policy clauses and delays in processing claims.

One of the most concerning practices is the frequent invocation of the ‘reasonability clause’, where insurers unilaterally reduce claim amounts without adequate justifications.

In one example, a policyholder’s legitimate hospital bill was drastically slashed, underscoring how insurers often manipulate such clauses to avoid paying full claims.

Claim rejections are another frequent challenge for policyholders. Insurers sometimes find loopholes in policy terms, rejecting legitimate claims by categorising certain activities as ‘risky’, even when the policy covers such events

Does IRDA ever think about the Agents and the Senior Citizens? The scope for general insurance companies’ agents for expanding their business are getting squeezed day by day though insurers are launching new products without providing proper training to the individual agents. Moreover, most of the agents are not comfortable with handling electronic conversation of underwriting. Can IRDA consider and compel the general insurance companies including the PSUs to take proper measure on these issues?

Sri Debasish Panda ,

Chairman

Insurance Regulatory and Development Authority of India.

Hyderabad

Hyderabad

13-01-2025

Respected Sir,

Namaskaram

I am Ramesh Gangashetty retired officer from State Bank . I am submitting hereunder some facts about the Insurance business in India. It is not a complaint but submission for your necessary intervention .

There is an interesting revelation regarding the ” INFLATED HOSPITAL BILLS” by the Ex IRDAI G. M. He has exposed some facts about the Hospital Bills .

The Retired G. M. ( I R D A I) has observed that the Hospitals are charging the InPatients more than the Maximum Retail Price ( MRP) for the medicines and for several other medical aids. The Hospitals are also violating the Packaged Commodity Rules and failed to comply with Packaging regulations and omitting crucial information about the Packaged items.

Further , some time back there was a similar half an hour presentation on Hindi News Channel (Aaj Tak) regarding the Life Insurance business in India. It was a detailed presentation covering almost every aspect of Life Insurance business. Again on 30th December 2024 , there was a detailed report about the same subject in The Times of India news paper.

Several interesting matters relating to the Insurance business covered in these two presentations.

It is a fact that the Employees and the Retirees are the most prompt and disciplined Premium Payers to the Insurance Cos. The Employees pay the Insurance Premium from their hard earned salary and the Retirees pay the Insurance Premium from their Pension which they receive for difficult days. These people form a BULK PREMIUM payers group for the Insurance Cos and are the main consumers for Insurance Cos.

In the aforesaid Media presentations, it is stated that the relationship between the Insurance Premium Payers and the Insurance Cos is established on basis of a Agreement . It is said that the Agreement format contains more than 40000 words covered in about 44 pages where in more than 60 terms and conditions are stipulated of which any non-compliance of the term will lead to the rejection of the Claim . Further the Report states that the matter in the Agreement is typed in very small letters which can not be read with bear eyes. It says that most of the Insurance Premium Payers do not read the complete Agreement.

The Insurance Cos promptly pay the bills to the Hospitals on the receipt of the Bills. But in many cases ,the Insurance Cos refuse to reimburse the cost of several items/ services to the Insured person stating that they are not as per the eligibility or not within the permissible limits of the Insured person. It results some time, the Insured person has to pay huge amounts for final settlement of the bill .

But seldom the Insurance Cos reject the bill amounts submitted by the Hospitals for not providing any genuine Service or Correct Facility as per the eligibility of the Insured person. It is seen that the cost of several medicines and medical aids supplied to the inpatients are abnormally very high compared to rates in Retail Medical Shops. Some time the rates of medicines supplied to the inpatients are 4 to 5 times more than the MRP rates. But contrary to this, now a days on small retail shops also the medicines are available with 25- 35 % discount. But the Insurance Cos do not take up this matter of abnormal prices of medicines and other medical aids with the Hospital authorities. Further the cost of the same Services or Medicines provided to inpatients in different categories of accommodations are charged differently . It is said that these tariffs are based on the category of accommodation provided to the inpatient. It appears illogical.

It is important to note that once the CLAIM is approved by Insurance Cos , the Insurance Cos become the Custodian of the money to the extend of the sanctioned amount. The Insurance Cos pay the bills amounts on the behalf of Insured person. As such , it is the responsibility of the Insurance Cos to pay the money to the Hospital authorities asper the bills submitted after verifying and satisfying that the prices of the medicines and medical aids are normal and ensure that the cost of the Services and Facilities provided to the inpatients are genuine and correct and are as per the eligibility of the insured person.

These are not complaints but findings / observations revealed in different presentations and studies regarding the Hospital Business that is Life Saving Industry . Unfortunately it is no more Life Saving Activity but has become a Life Saving Commercial Industry.

There is urgent need to intervene from different agencies , authorities and monitoring organisations.

Hyderabad

11-01-2025

From :-

Ramesh Gangashetty

302 Surya Residency

Domalguda,Himmatnagar

Hyderabad 500029

Mob no 9052991100

Email ID:- rbgshetty@gmail.com

SHETTY

10 -01 -2025