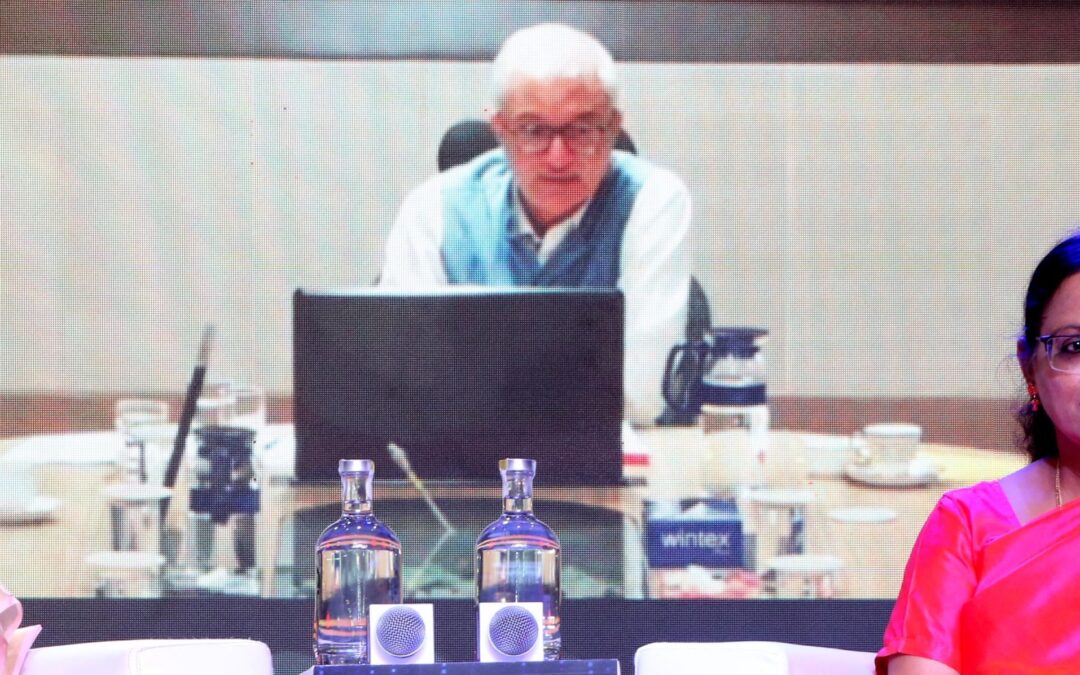

From( L to R) , Deepti Gaur Mukerjee, CEO, National Health Authority, Vivek Joshi, secretary, Department of Financial Services(Virtual), Girija Subramanian, CMD, New India Assurance at the 106th Foundation day celebration of New India Assurance

The government is currently focusing on ease of doing business and working towards achieving `Insurance for all by 2047’. For this, both private and public players need to play an effective role,’’ Vivek Joshi, secretary, Department of Financial Services

Mumbai: The government wants the PSU insurers must reskill their employees and deploy best of the technologies to provide the world class services to their customers, said Vivek Joshi, secretary, Department of Financial Services.

He was speaking (virtually), on Friday, at the 106th Foundation day celebration of New India Assurance, the largest Indian multinational general insurer.

The PSU insurers have shown financial resiliency and upheld the virtues of nation building, Joshi commended.

The government is currently focusing on ease of doing business and working towards achieving `Insurance for all by 2047’. For this, both private and public players need to play an effective role,’’ he said.

Joshi also highlighted the government’s efforts to achieve financial inclusion and providing social securities to the masses.

“What should matter for insures are end-users. Innovation and customisation, financial assistance are the need of the hour,’’ said Joshi

The PSU insurers should be insurers of choice and carry the trust and confidence of the people, Joshi advised.

BS Rahul,CMD,United India Insurance(R), is presenting a bouquet to Girija Subramanian, CMD , New India Assurance at NIA’s 106th Foundation day celebration

As Indian economy is on its way to transform itself from a developing country to a developed one, the PSU insurance industry will have an important role to play in it, he emphasised.

Addressing the event, Deepti Gaur Mukerjee, CEO, National Health Authority(NHA), said the government is now focussing on the missing middle and universal health coverage.

The NHA is responsible for implementing the government’s flagship health insurance scheme Ayushman Bharat Pradhan Mantri Yojana (AB PM-JAY) and Ayushman Bharat Digital Mission (ABDM) for integrating digital health infrastructure in India and National Health Claim Exchange(NHCX).

“We are working on ensuring universal high-quality healthcare services at an affordable cost,” she said.

NHCX is providing gateway for claims settlement digitally. Insurance regulator IRDAI, NHA and General insurance council are working together on it. Almost 99 per cent of general insurers have already been on boarded for NHCX, informed Mukerjee.

According to Mukerjee, till date, over 65 crore ABHA (Ayshman Bharat Health Account) have already been created under the Centre’s flagship scheme AB PM-JAY.

ABHA , a 14 digit number that uniquely identifies a citizen as a participant in India’s digital healthcare ecosystem, comes with several benefits for citizens including storing and managing their health records safely. It also allows them to share their health records securely with doctor anytime and anywhere with their consent.

Through ABHA, citizens can avail several digital health benefits from avoiding the long queues at healthcare facilities for registration to facilitating doctor appointments.

Mukerjee further said Aarogya Sethu, which was launched during Covid-19 pandemic is being repurposed now as a health and wellness application.

Aarogya Setu and CoWIN applications are being modified to address India’s emerging digial health needs. The central government is working on repurposing the two digital health platforms, that were used to monitor and manage the COVID-19 pandemic, to manage other public health concerns, under the umbrella of the Ayushman Bharat Digital Mission, explained Mukerjee.

CoWIN has been extensively used in implementing Covid-19 vaccination and will now be used for India’s universal immunization program. It will be repurposed for the immunization program and as a health management information system for small doctors.

PSU Insurers not only have to restructure their offices, they should restructure their manpower as per their ability and performance.

Now, no one is customer friendly.

It is difficult to get proper minimum services from PSU insurers by the customers.

Most of the insurance personnel do not have proper knowledge either to deal with insurance proposal or claims.

Because of the trust the Government companies have , people still go to them for their Insurance requirements.

M.S.Kumar explained state of the PSU insurers. It is very much true.

Even now there is no accountability at any level.

Examples please.

Heard about today’s accident involving Howrah-Mumbai mail? How many days have gone by since the accident involving Kanchenjungha express? Not to speak of the accidents galore prior to that in 2024 itself.

Who have been held accountable? Small fries. Not the Big Fishes. Let alone the Railway Minister who is simultaneously holding a slew of other portfolios apart from such an important one called the Railways!!

Have you ever thought of holding the biological turned Non-Biological PM accountable for anything at all?

Isn’t it contradictory Mr Kumar that despite all ills (actual or imaginary) afflicting the PSGICs, “people still go to them…..”. Do introspect as to what on earth is/are behind that trust-building. Remember it has long ceased to be a level playing field. The Ruling Dispensation in cahoots with the Corporates both domestic & transnational have nearly finished the PSGICs and once their next & the most important target LICI finally capitulates to the relentless onslaught of the Evil Axis, the annihilation of Public Sector in India’s Insurance Industry will be COMPLETE.

It is not possible in PSU insurance to choose best employees due to SC/ST reservation. Private company can take steps.

U N SHARMA JI employees of NIC and SC category (SC/ST employees) in PSU insurers doing hard work more than other employees from general categories, kindly give up your Manusmriti mindset and think neutral, remove the dirt from your mind that SC and ST are not the best employees.

Because of people like you, casteism has become so bad that we will throw it out soon.

Can’t agree more.

UN Sharma ji, pl don’t spreading hatred, you don’t know how many people are living with this kind of mindset or spreading hatred in the society, please send your name or address and comment Shri Chander Shekhar Azad

Reskilling is indeed very laudable idea. However, training /learning as an important ingredient must be taken up on vigorously.

Theory n practice of Insurance handling with empathy, integrity, transparency in a dynamic field can and will improve the performance with the aid of advances in digital technology. But one must reckon that it is humongous task but achievable with dedication n planning.