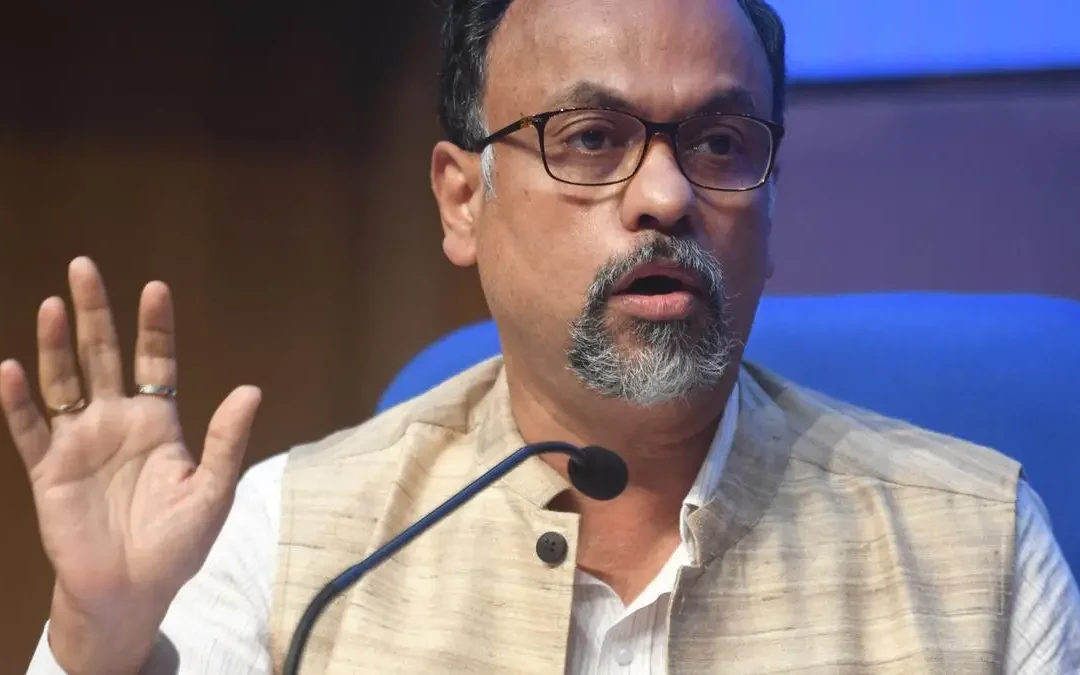

Debasish Panda,chairman,IRDAI

Though, earlier, IRDAI had set a deadline of July 2024 for the Bima Sugam project to go live, observers point out delay in operation as the set of key components of this insurance electronic marketplace , including forming a company, appointing a CEO and above all developing a comprehensive IT platform are yet to start

Hyderabad:

Insurance regulator IRDAI chairman Debasish Panda will meet some of the chief executive officers(CEOs) of the Indian insurance industry in Mumbai, on Friday, to review implementation of its game changing moves like Bima Sugam and ‘Cashless Everywhere’.

Panda along with other senior officials of the IRDAI, will be busy meeting some of the CEOs in two separate sessions whole day, said industry sources.

In the morning, he will be discussing with CEOs on how to now complete the final phase of Bima Sugam project, for which it has already unveiled comprehensive regulations that have already been notified by the government during the last week.

Among other regulations, IRDAI has banned any form competition against Bima Sugam, for which the insurance industry wants more clarifications as there are now a lot of insurance e-commerce platforms, set up by various players in the industry.

Though, earlier, IRDAI had set a deadline of July 2024 for the Bima Sugam project to go live, observers point out delay in kickstarting operation as the set of key components of this insurance electronic market place, including forming a company, appointing a CEO and above all developing a comprehensive IT platform, are yet to start.

The regulator had formed a steering committee, which acts as the apex decision making body for creation of Bima Sugam platform, to be built with an initial capital of Rs 200 crore.

Some of the members of steering committee are: Rajay Kumar Sinha, member, Finance and Investment, IRDAI, Anup Bagchi, MD & CEO ICICI Prudential Life Insurance, Mahesh Balasubramanian, MD & CEO, Kotak Life Insurance, Nilesh Garg, MD & CEO, Tata AIG General Insurance, Prasun Sikdar, MD& CEO, Manipal Cigna Health Insurance, Inderjeet Singh, secretary general, General Insurance Council, Satyendra Nath Bhattacharya, secretary general, Life Insurance Council.

All members of steering committee will be attending the Friday’s review meeting

.In the second session to be held in the afternoon, Panda will meet exclusively CEOs of the general insurance industry to review ‘Cashless Everywhere’ initiative, wherein policyholders can get treated in any hospital they choose, and a cashless facility will be available even if such a hospital is not in the network of a particular insurance company.

Though it has become officially effective since Feb 1, a lot of mechanisms of the scheme including empanelment of hospitals and other nitty gritty details have not been in place yet.

General Insurance Council is still struggling with hospitals to make them agree to certain terms and conditions of this nationwide scheme.

The review meeting may also discuss the recent development where the Supreme Court has given an ultimatum to the government to come out soon with standardized rates for hospitals charges across the country as insurers will be hugely benefited by such a move.

Great efforts by IRDAI

A great initiative. Let psus take initiatives in appointment of new agents, which no one seems to be really interested. Only then insurance penetration will increase

Really, a great step ahead in the Indian insurance industry. Of course improvements can be expected on that but to start with, it is remarkable. Today, whole process of cost estimation, insurance approval and huge amount of deposit demand by hospitals at the time of emergency is a joke in the so called CASH LESS medical insurance policy.

IRDAI is a white elephant. It did nothing in last 24 years to protect policyholders from nitty gritty of private companies legal jargon. It did nothing to protect small agents interests. Data reveals that only three agents out of every 10 agents survive in insurance market.

First, let the steering committee understand Mr. Panda s Bima Sugam project thoroughly . Sale and only Sale is now the mantra of Insurance Companies. This sale & only sales policy has prompted One high official of IRDAI (name withheld) to utter ” Insurance Industry lacks human capital in administration ” . A lot of job remains to be done before effective implementation of the Bima Sugam . We must try to find out the talents for spreading awareness & penetration.

In proposal form, there should be in bold letter Box where insured has to mentioned his/her details of existing diseases if any and sign properly to avoid any last minute dispute .

Same has to be checked by insurance company twice at the time of processing file. The practice is there, but not all companies do them properly.