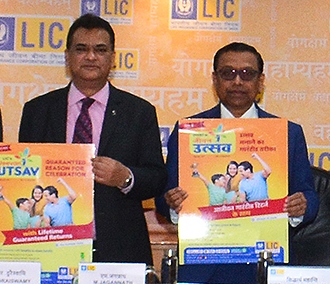

(Lto R) M Jagannath, MD, LIC and Siddhartha Mohanty,chairperson, LIC at the launching ceremony of corporation’s new product Jeevan Utsav

Siddhartha Mohanty,chairman, IRDAI had said the new product is poised to disrupt the market and that there is a widespread interest among insurance buyers in understanding the transparent cost structure and returns over a period of 20-25 years

Mumbai

Insurance behemoth LIC on Wednesday launched its guaranteed return plan, Jeevan Utsav.

It is a non-linked, non-participating, individual savings, whole life insurance plan, LIC said in a regulatory filing.

This plan is available for age starting from 90 days to 65 years. It gives guaranteed life long income and life long risk cover.

LIC Chairman Siddhartha Mohanty had recently said policyholders can expect a lifelong benefit of 10 per cent of the sum assured after the policy matures.

Mohanty had said the new product is poised to disrupt the market and that there is a widespread interest among insurance buyers in understanding the transparent cost structure and returns over a period of 20-25 years.

The minimum premium paying term is 5 years and maximum premium paying term is 16 years.

For each policy year for which premium is paid, the Guaranteed Additions at Rs. 40 per

thousand Basic Sum Assured shall accrue at the end of each policy year during the premium paying term.

On survival of the Life Assured after Premium Paying Term, the Policyholder can choose

from:

Option I- Regular Income Benefit – which is 10% of the Basic Sum Assured, payable at the end of each policy year, starting after 3 to 6 years of the deferment period.

Option II- Flexi Income Benefit – Policyholder can opt for Flexi Income Benefit under which 10% of the Basic Sum Assured payable can be accumulated and withdrawn later, subject to the terms and conditions of the policy.

LIC shall pay interest on such Deferred Flexi Income payments at 5.5% p.a.