The company will primarily operates in the NBFC market and credit market segment and has strategic plans to expand its operations into insurance, digital payment, and asset management verticals

Mumbai:

Jio Financial Services, the demerged financial services unit of Reliance Industries, will be listed on bourses on August 21, according to an exchange notification.

Jio Financial Services Ltd (JFSL) demerged from Reliance last month and is currently listed under a dummy ticker after its price discovery at Rs 261.85 but there is no trading happening in the scrip.

The company will primarily operates in the NBFC market and credit market segment and has strategic plans to expand its operations into insurance, digital payment, and asset management verticals.

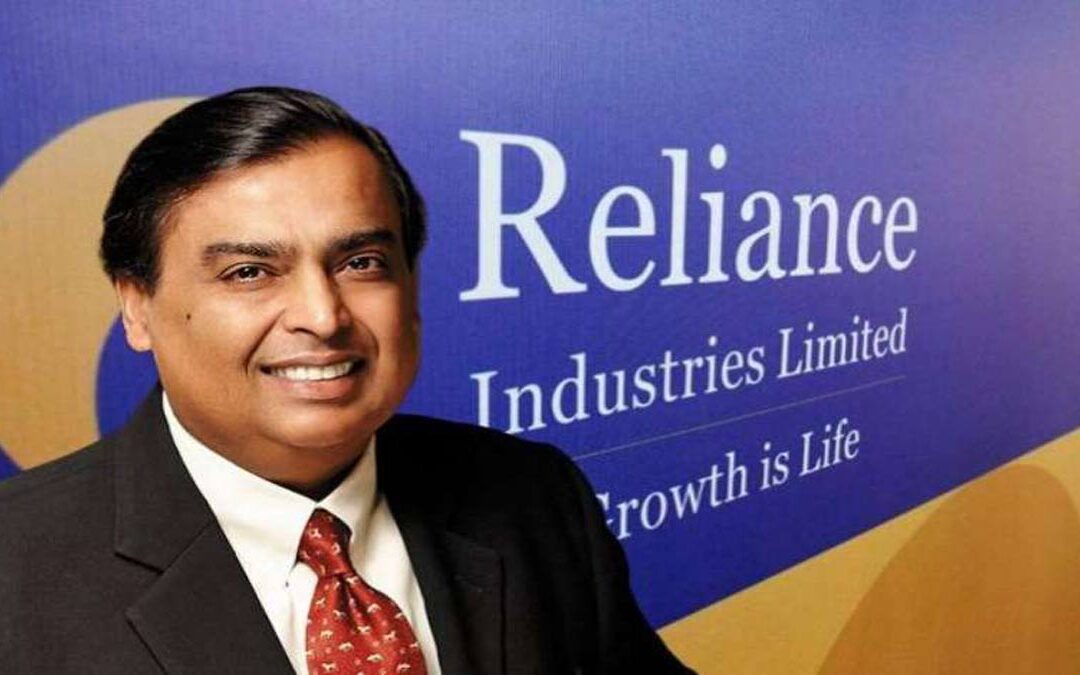

Reliance Industries’ Chairman and Managing Director Mukesh Ambani in his message to shareholders in the company’s 2022-2023 annual report, said, Jio Financial Services is positioned uniquely to capture the growth opportunities in the financial services sector and play a crucial role in transforming the landscape of digital finance in India.

The listing on BSE and NSE has been scheduled a day before FTSE Russell plans to drop JFSL from its indices.

The index services provider said it took the decision as the stock was yet to start trading on bourses.

“Trading Members of the Exchange are hereby informed that effective from Monday, August 21, 2023, the equity shares of Jio Financial Services Ltd (formerly known as Reliance Strategic Investments Limited) shall be listed and admitted to dealings on the Exchange in the list of T Group of Securities,” BSE said in a notice.

Jio Financial Services through its operating subsidiaries and joint ventures will offer broad range of financial services solutions addressing the needs of both consumers and merchants.

Last month, the company announced its tie up with Blackrock, world’s largest asset manager, to float a mutual fund company. Together, the partnership will introduce a new player to the India market targeting initial investment of $300 million.

The shares of Jio Financial Services were credited to demat account of shareholders last week. As part of the demerger, Reliance shareholders would got one share of Jio Financial Services for holding one share of Reliance Industries.