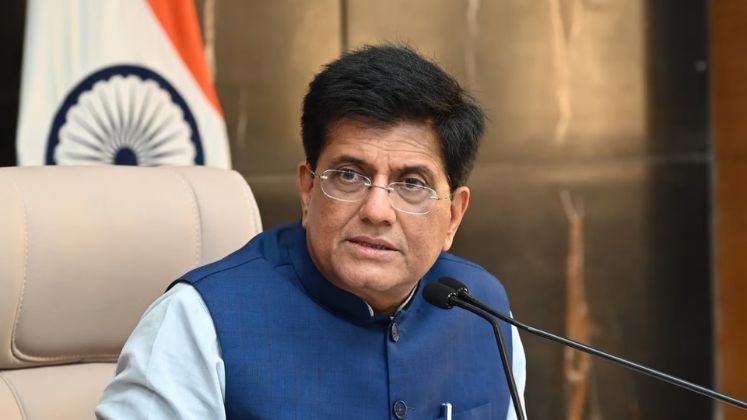

“We have not been encouraging cryptocurrency, which does not have sovereign backing or which is not backed by assets, say it on the federal bank or local currency. India has also announced that we will be coming out with a digital currency, which will be backed by a Reserve Bank of India guarantee-like currency. Our idea is that this will only make it easier to transact. It will also reduce paper consumption and will be faster to transact than the banking system. But it will also have traceability,” Union Minister Piyush Goyal

Union Minister Piyush Goyal stated that India does not encourage cryptocurrencies that lack sovereign or asset backing, such as those not supported by the Reserve Bank of India (RBI) or a local currency.

He announced that India will introduce a digital currency backed by an RBI guarantee, aimed at simplifying transactions, reducing paper usage, and enabling faster, traceable transactions compared to traditional banking.

“We have not been encouraging cryptocurrency, which does not have sovereign backing or which is not backed by assets, say it on the federal bank or local currency. India has also announced that we will be coming out with a digital currency, which will be backed by a Reserve Bank of India guarantee-like currency. Our idea is that this will only make it easier to transact. It will also reduce paper consumption and will be faster to transact than the banking system. But it will also have traceability,” he said.

Goyal clarified that while there is no outright ban on cryptocurrencies without Central government backing, they are heavily taxed to discourage their use due to the risks associated with their lack of backing and accountability.

“As far as cryptocurrency, which is not backed by the Central government [is concerned], while there is no ban as such, we are taxing it very heavily. We don’t encourage it because we don’t want anybody to be stuck at some point with a cryptocurrency that has no backing and nobody at the backend,” he said.

On Monday, Goyal announced that a business delegation visit aimed at expanding bilateral trade and investment.

“I would think that sometime by the middle of next year, or third quarter of next year, we will be able to finalise an FTA, if not earlier,” Goyal told reporters in Doha.

Qatar ranks among India’s key trading partners within the Gulf Cooperation Council (GCC), with bilateral trade totalling over USD 14.15 billion in 2024-25. The GCC comprises Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

India has already secured a trade pact with the UAE and is expected to sign a similar agreement with Oman in the near future.

Minister Goyal held discussions with his Qatari counterpart, Sheikh Faisal bin Thani bin Faisal Al Thani, on launching FTA negotiations. Both ministers agreed to fast-track the process to support their ambitious goal of doubling bilateral trade.