This innovative system, with a view to transforming India’s reinsurance landscape, brings together all key stakeholders (Cedants(insurers) , Intermediaries and Reinsurers) onto a single, unified platform that transforms how reinsurance transactions totalling Rs 1.14 trillion(FY25) are managed across India

Mumbai:In a significant development, the General Insurance Council(GI Council), the official association of Indian re/insurers, is now ready to launch the high tech-platform, The Reinsurance Exchange, long planned by the IRDAI, to facilitate industry-wide reinsurance transactions online, from Apr1.

The online Reinsurance Exchange- The Electronic Transaction Administration And Settlement System for Reinsurance(ETASS Re)- was conceptualised by the IRDAI way back in 2010 as a comprehensive electronic platform for Domestic Outward reinsurance business.

This innovative system, with a view to transforming India’s reinsurance landscape, brings together all key stakeholders (Cedants(insurers) , Intermediaries and Reinsurers) onto a single, unified platform that transforms how reinsurance transactions are managed across India.

From Apr 1, to begin with, all the reinsurers doing Indian business need to upload their reinsurance chart that can be tracked by the rest of the participants of a particular deal. However, they can’t place their business nor make payment through the platform where reconciliation of all reinsurance deals can be tracked.

The country has 34 general insurers includuing seven stand alone health insurers(SAHIs), two Indian insurers GIC Re and ValueAttics Reinsurance, jointly owned by Prem Watsa and Kamesh Goyal, , around 14 IFSC Insurance Offices (IIOs) in GIFT City, Gujarat. Also around 280 cross boarder reinsurers (CBRs) deal with Indian reinsurance market, with a size of Rs 1.14 trillion.

The GI council, after getting approvals from the insurance regulator, IRDAI has recently unveiled the different features of this comprehensive roadmap for digital transformation of reinsurance operations in India.

The platform is well equipped to manage all the aspects of reinsurance supply chain except online payment and now even include brokers in this system .

Currently, the industry faces following challenges in its reinsurance business –

Streamline Operations: Address unreconciled balances that created operational friction and financial uncertainties across the reinsurance value chain.

Drive Transparency: Create clear visibility into reinsurance operations while maintaining appropriate confidentiality standards.

Ensure Timeliness: Mandate prompt submission of Statements of Accounts (SOAs) and settlements to improve cash flow predictability.

Scope of ETASS Re Phase I

-Contracts:Digital lifecycle management with authenticated participation and unique tracking of contracts commencing from 1st April 2026

-Accounting:Transparent submission and confirmation of all accounting entries with complete audit trails

-Offline Settlement:Settlement tracking with automated reminders and offset capabilities.

-Reporting:Comprehensive dashboards, regulatory reports, and actionable insights for all stakeholders.

Contract Management Core Capabilities

-Contract Creation & Confirmation:Supports creation of both manual single-contract entry and efficient bulk uploads via Excel templates, providing flexibility for different operational needs with authenticated participation from all parties.

-Security & Confidentiality:Robust confidentiality protocols ensure sensitive contract terms remain protected while maintaining necessary transparency.

– Error Correction & Endorsements:Built-in mechanisms for correcting typing errors and processing endorsements for changes in contract terms

– Complete Traceability: Every contract receives a unique identifier, enabling precise tracking of eachplacement and its participants throughout the lifecycle.

-Real-Time Tracking:Monitor contract progress at every stage with comprehensive status updates visible to all authorized participants, ensuring no contract falls through the cracks.

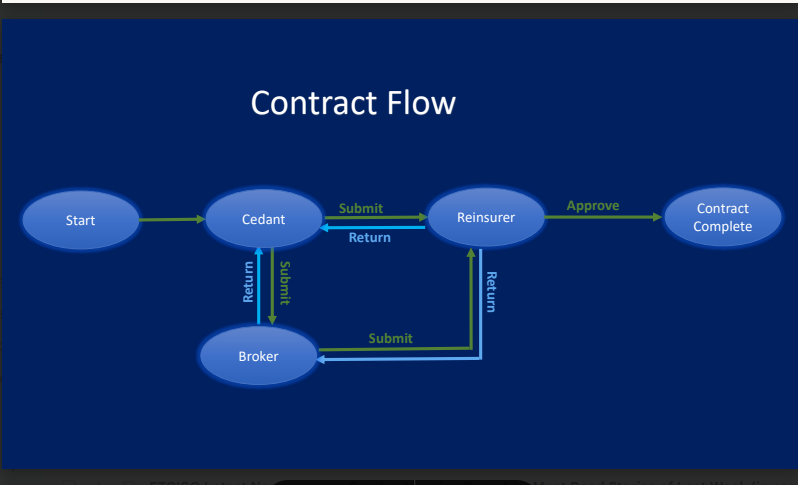

Contract Workflow Process: Understanding the approval flows for direct and broker-facilitated reinsurance contracts.

Direct Placement Workflow:When cedants place reinsurance directly with reinsurers without intermediary involvement, the workflow follows a streamlined bilateral approval process.

Cedant Submits:Ceding company initiates contract and submits for reinsurer approval Reinsurer Reviews: Reinsurer can approve or return with comments Contract Finalized: Upon approval, contract becomes active in the system.

Broker-Facilitated Workflow: When contracts are placed through intermediaries, the workflow incorporates an additional layer of broker review and coordination.

-Cedant to Broker: Cedant submits contract through broker channel

-Broker to Reinsurer:Broker reviews and forwards to reinsurer, or returns to cedant for modifications.

-Reinsurer Decision: Reinsurer approves or returns through broker to cedant.

Contract Complete:Multi-party confirmation finalizes the contract

Return Mechanism: At any stage, contracts can be returned to the previous party for clarifications or modifications, ensuring accuracy and mutual agreement before finalization. This iterative review process maintains quality control while preserving operational efficiency.

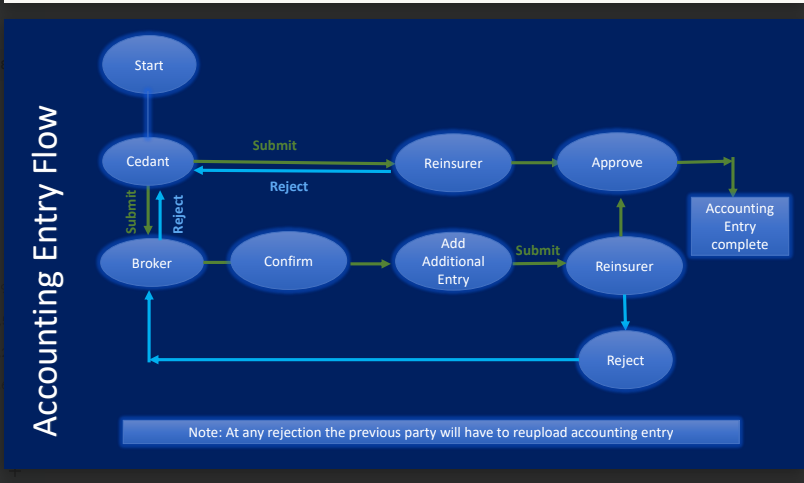

Transparent Accounting and Settlement

Cedant Submission: Initial accounting entries submitted by the ceding company.

Reinsurer Visibility: Complete transparency with separate ledger views.

Intermediary Review: Broker processes and forwards entries to reinsurers.

Comprehensive Accounting Features

-Proactive Management:Automatic reminders for pending entries thereby, preventing delays in accounting.

-Submission Flow :Accounting entries flow systematically, creating a clear audit trail.

Universal Confirmation: All participating parties must confirm accounting entries, creating consensus. Reinsurers gain unprecedented visibility thereby understanding the transaction chain.

Supporting Documentation:Document Management System enables each party to upload supporting document.

Enhanced Transparency: Reinsurers gain unprecedented visibility thereby understanding the transaction chain.

Multi-Party Confirmation: All parties confirm accounting accuracy

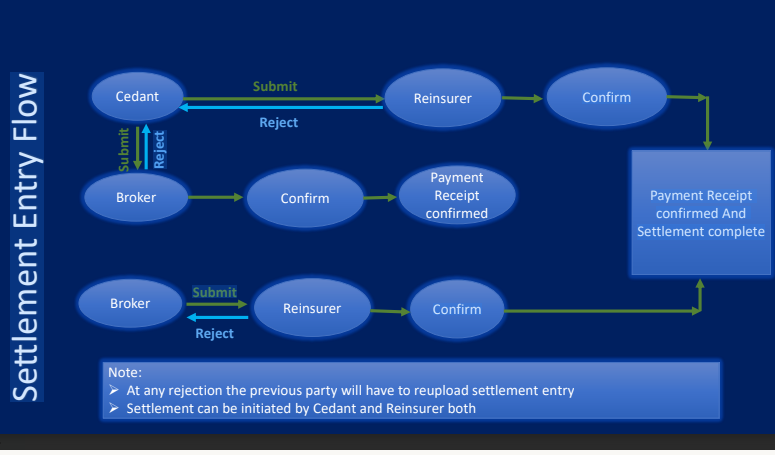

Settlement Management & Reconciliation

-Offline Settlement Recording :Comprehensive capability to update and maintain records of settlements, ensuring complete transaction history.

– Intelligent Offsetting: Offset functionality between transactions involving the same entities, reducing unnecessary cash movements and improving capital efficiency.

-Payment Confirmation:All parties confirm receipt of payments within the system, creating indisputable records and reducing reconciliation disputes.

Reporting & Dashboard Intelligence

ETASS Re provides a sophisticated reporting infrastructure designed to meet the diverse needs of all stakeholders while ensuring regulatory compliance. The platform delivers actionable insights through multiple reporting dimensions.

Standard Reports,Due to – Due From,Regulatory Compliance,Daily Actionable Reminders,Interactive Dashboards,Complete Data Access

For Registration and queries players can write to : etassre.support@gicouncil.in

Congradulations and Best Wishes.

It is requested/ suggested that IBAI should arrange for half a day workshop,invite all Composite Brokers,Insurers and Reinsurers before this is implemented.