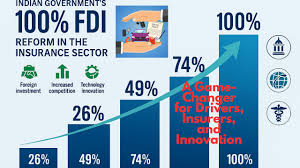

Now, insurance regulator IRDAI will come out with new set of regulations in accordance with the new Act which provides a host of changes including hiking FDI from 74 per cent to 100 per cent for the Indian insurance companies

The new Act introduces one-time registration for insurance intermediaries and Managing General Agents(MGAs)

New Delhi: Without losing time, the government has notified much-awaited new Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Act, 2025, on Sunday, which has now become the new law enlisting many new things for the Indian insurance indutsry.

“The Sabke Bima Sabki Raksha(Amendment of Insurance Laws) Act, 2025 enacted by Parliament received the assent of the President on the 20th December and is hereby published for general information,” said the gazette published by Ministry of Law and Justice.

On 16 and 17 December 2025, the Lower and Upper House of the Indian Parliament respectively passed the much-anticipated Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 (Bill).

The Bill had proposed amendments to the Insurance Act 1938, the Life Insurance Corporation Act 1956, and the Insurance Regulatory and Development Authority Act 1999.

The Act grants more power to the Indian insurance regulator IRDAI to further strengthen its oversight over the insurers and intermediaries.

Now, insurance regulator IRDAI will come out with new set of regulations in accorance with the new Act which provides a host of changes including hiking FDI from 74 per cent to 100 per cent for the Indian insurance companies.

Several of the changes would also require corresponding amendments to the foreign exchange regulations/ FDI rules and various IRDAI regulations, including the IRDAI (Registration, Capital Structure, transfer of Shares and Amalgamation for India Insurance Companies) Regulations, 2024 (“Registration Regulations”),said analysts.

Taken together, the changes in the new Act promise a decisive shift in India’s insurance landscape. Several of the proposals in the Act are measured and their full impact would depend to a significant extent on the conditionalities and specifics imposed in subordinate legislation, analysts highlighted.

The Act primarily focus on promoting policyholders’ interests, enhancing the financial security of the policyholders, facilitating entry of more players in insurance market thereby leading to economic growth and employment generation, enhancing efficiencies of the insurance industry, enabling ease of doing business and enhancing insurance penetration to achieve goal of “Insurance for All” by 2047.

The newly introduced Section 3AA requires that any increase in foreign investment will be in the manner, and subject to such conditions, as may be prescribed by the Central Government. It appears that the relaxation in the FDI cap will be tied to the proposed changes in the Draft Rules, which are:

-The requirement of having only one individual among the Chairperson, Managing Director, or Chief Executive Officer of the insurance company as a resident Indian citizen.

-Deletion of earlier provision in the Foreign Investment Rules which mandated companies with more than 49% foreign investment to appoint 50% independent directors as part of its Board. The new Act relaxes this requirement to 3 independent directors.

-Deletion/relaxation of various requirements imposed on insurance intermediaries with majority shareholding of foreign investors, including those related to the residency of directors/KMPs, prior approval of the regulator for repatriation of dividend, composition of the company’s board to be as per the directions of regulators, etc.

-Amended definition of “Insurance Business”: The Insurance Act 1938 did not contain any definition of “insurance business”. The Act now seeks to define this term to mean the business of effecting insurance contracts, as well as any other form of contract that may be notified by the Central Government in consultation with the IRDAI from time to time. What presently remains unclear is whether such other contracts will include non-insurance activities, or will they only be restricted to services fundamentally connected to the insurance business.

-Wider powers to IRDAI: The Act enhances the IRDA’s powers by allowing it to frame new regulations and amend existing regulations (without publishing draft regulations) where such amendments/regulations only concern internal functioning of the IRDAI, or are required in the public interest.The IRDAI is now empowered to disgorge wrongful gains made by the insurers/intermediaries.

-One-time registration and introduction of MGAs: To simplify compliance and ensure continuity, the Act introduces one-time registration for insurance intermediaries.

-Share capital transfers: The Act raises the regulatory approval threshold to 5% from the current 1% for share capital transfers in insurance companies. The change is expected to encourage investment in these companies without having to route the same through the regulator.

-Recognition of online premium payment: The Act has introduced a definition of “premium” which means the amount paid or payable as consideration to the insurer by the policy holder for a contract of insurance. Recognising the prevalent market practices, the Actl also provides recognition to online modes of premium payment to insurers.

-Mergers with non-insurance companies: In yet another bold shift, the Act provides that the merger of insurance business of an insurer with the non-insurance business of a company may be achieved subject to the prior approval of the IRDAI. It is expected that the IRDAI will be prescribing specific regulations and mechanisms governing such amalgamation or transfer of insurance and non-insurance businesses.

-Higher penalties for violations: The Act enhances the maximum penalty for violations of the Insurance Act and associated regulations from INR 1 crore to INR 10 crores. Additionally, in determining the quantum of penalty for any contravention or default, the IRDAI will take into account factors/tests prescribed under the Act, including the nature, severity, and duration of the default, repetitiveness of the violation, any disproportionate gain or unfair advantage derived by the violation, and the loss suffered by policyholders as a consequence of the default.

-Changes to reinsurance: The Act lowers the minimum capital requirement for foreign reinsurance branches and Lloyd’s or its members to ₹1,000 crores (c. $110m) from ₹5,000 crores (c. $553m).

-Executive Council of Life and General Insurance Council to be expanded with 7 members from the industry (up from 4), 2 eminent persons (up from 1), 2 persons nominated by Central Government, in addition to other representatives

-Establishment of Policyholders Education and Protection Fund to which grants and donations from Governments and the sums realised by way of Penalties by IRDAI shall be credited