“As India’s most trusted insurance partner, New India Assurance takes pride in passing on maximum benefit accruing out of this exemption to our valued customers. NIA commits to put in all possible efforts to make Viksit Bharat 2047 a reality, through insurance as a financial inclusion tool,’’ said Girija Subramanian, CMD, NIA

Mumbai: Taking a lead, New India Assurance, the largest general insurer in the country, has said it is ready to pass on maximum benefit of GST exemption to all its retail Health Insurance customers after the government’s decision to remove the existing 18 per cent GST on retail Health and Life Covers from September 22.

“NIA salutes the government’s decision to exempt individual health insurance from GST effective 22nd Sept 2025. As India’s most trusted insurance partner, NIA takes pride in passing on maximum benefit accruing out of this exemption to our valued customers. NIA commits to put in all possible efforts to make Viksit Bharat 2047 a reality, through insurance as a financial inclusion tool,’’ said Girija Subramanian, CMD, NIA.

The details of proposed reduction in NIA’s retail Health Insurance premium are currently being worked out, said sources in the company, which has the largest Health Insurance portfolio in the country.

R Doraiswamy, CEO & MD, Life Insurance Corporation, said “, LIC thanks chairman GST Council Nirmala Sitharaman, finance minister, for taking visionary initiative of removing GST on Individual Life Insurance Products, a step towards making Life Insurance more affordable to all the citizens of the country to meet the objective of Insurance for all by 2047.”

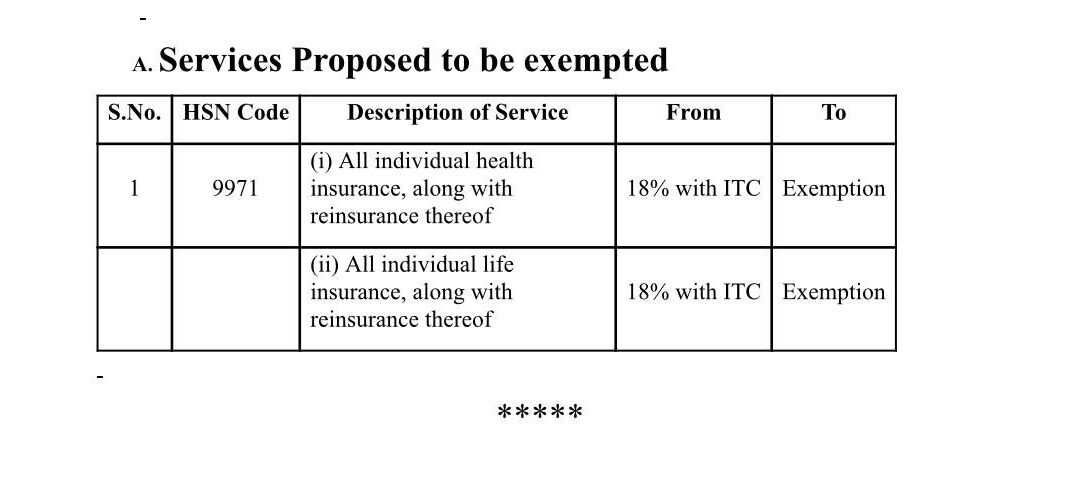

Nirmala Sitharaman, finance minister, on Wednesday had announced the removal of 18 per cent GST from the re/insurance premiums of all retail Health and Life products with effect from Sep 22 after the GST Council approved a large scale GST overhaul.

`We have decided to remove 18 per cent GST from all individual Life and Health Insurance to make them affordable for common man and widen country’ insurance coverage. The Health Insurance will also cover family floater and senior citizens. The reinsurance premium of these retail Health and Life covers will also be exempted from GST. We will ensure insurers pass on GST removal benefits to customers.”

The Council, which began its two-day meeting on Wednesday, under the chairmanship of Sithraman, had decided to reduce the number of slabs in GST to just two — 5 per cent and 18 per cent — and removing the 12 per cent and 28 per cent slabs.

Also, a special 40 per cent tax will be slapped on a select few items, including and ultra-luxury goods.

Rushabh Gandhi, MD & CEO, IndiaFirst Life Insurance, said the GST Council’s recommendation to exempt life insurance products across all retail categories is a progressive step that will accelerate insurance penetration in India.

“While the move may lead to some rebalancing in product preferences — particularly between individual term plans and group credit life, the long-term impact will be positive. Despite short-term margin pressure on the industry’s profitability because of the classification under the ‘exempt’ category, we believe the expected growth in premiums will strengthen the industry in the medium term and support sustainable expansion, said Gandhi.

Tapan Singhel, MD & CEO, Bajaj Allianz General Insurance and chairman of General Insurance Council, the official representative body domestic general insurers, said the GST Council’s decision to bring health insurance under the NIL GST bracket is a landmark move that will make healthcare protection more affordable and accessible for millions of Indians.

“At a time, when medical inflation is rising steeply, this step directly benefits citizens and eases the financial burden on families. It is also in complete alignment with the vision of Insurance for All by 2047, enabling more people to secure their health and future. This progressive decision will accelerate insurance penetration and strengthen the nation’s health security.” added Singhel.

The exemption of GST on all individual life insurance policies, whether term life, ULIPs, or endowment and on individual health insurance policies, including family floater and senior citizen plans, marks a historic step towards universal insurance inclusion, said Narendra Bharindwal, president, Insurance Brokers Association of India (IBAI).

This will make insurance more affordable for households across all segments and ensure greater penetration of life and health insurance, supporting India’s vision of “Insurance for All by 2047,” he said.

Passing on the benefit .. is compulsory after all ! The insurance companies are only custodians of the govt.’s money, until they remit

The effect of ITC would prevent insurers to pass on complete benefits. The basic cost would marginally go up if cross subsidisation is not resorted to

Shall get pro-rata refund for remaining period yr premium paid?

Whether GST is also exempted in Grouo Health insurance for retired persons?

What about Group Health insurance policies whose premiums are paid individually and GST charged on whole amount of premium agreed between insurer and insured.

There is anomaly for GST exemption for Group Insurance & Individual insurance. If the benefit of 0 GST is decided for individual insurance policies, why it should not be applied to group insurance policies also, because any group insurance policies also consistency of individual insurance policy holders.

Insurance industry and govt. should also passed this 0% GST for group insurance polies too under life insurance and health group insurance too.