“We have decided to remove 18 per cent GST from all individual Life and Health Insurance to make them affordable for common man and widen country’ insurance coverage. The exemption on Health Insurance will also cover family floater. The reinsurance premium of these retail Health and Life covers will also be exempted from GST. We will ensure insurers pass on benefits to customers,” said Nirmala Sitharaman, finance minister in a late evening press conference

The Council has also exempted GST from 33 drugs and medicines including cancer, rare diseases and chronic diseases

HSBC’s analysis suggests that a full exemption of GST could reduce health insurance premiums by around 15 per cent.

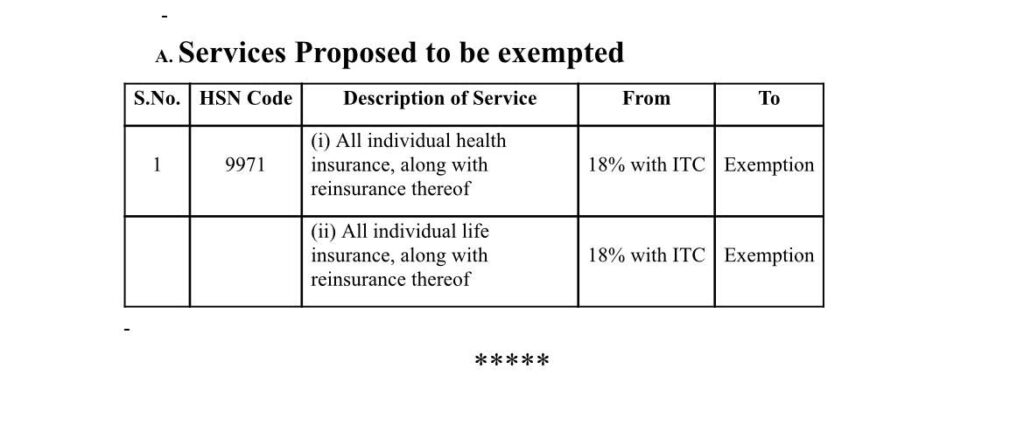

New Delhi: It is now official. In a significant move to widen India’s insurance coverage , the GST Council on Wednesday has decided to remove 18 per cent tax from retail Life and Health Insurance premium from Sept 22.The exemption will also be applicable on reinsurance premium of these retail Life and Health covers.

Currently, health and life insurance premium attracts 18 per cent GST.

“We have decided to remove 18 per cent GST from all individual Life and Health Insurance to make them affordable for common man and widen country’ insurance coverage. The Health Insurance will also cover family floater and senior citizens. The reinsurance premium of these retail Health and Life covers will also be exempted from GST. We will ensure insurers pass on GST removal benefits to customers,” said Nirmala Sitharaman, finance minister in a late evening press conference.

The Council has also exempted GST from 33 drugs and medicines including cancer, rare diseases and chronic diseases, said

However, the finer details of the decision to remove 18 per cent GST from Life and Health Insurance is not known yet and will be announced by the government soon.

“The GST Council’s decision to bring health insurance under the NIL GST bracket is a landmark move that will make healthcare protection more affordable and accessible for millions of Indians. At a time, when medical inflation is rising steeply, this step directly benefits citizens and eases the financial burden on families. It is also in complete alignment with the vision of Insurance for All by 2047, enabling more people to secure their health and future. This progressive decision will accelerate insurance penetration and strengthen the nation’s health security.” said Tapan Singhel(in pic), MD & CEO, Bajaj Allianz General Insurance and chairman of General Insurance Council, the official representative body domestic general insurers.

The Council, which began its two-day meeting on Wednesday, under the chairmanship of Sithraman, has decided to reduce the number of slabs in GST to just two — 5 per cent and 18 per cent — and removing the 12 per cent and 28 per cent slabs.

Also, a special 40 per cent tax will be slapped on a select few items, including and ultra-luxury goods.

Popular soft drinks, such as Coca-Cola and Pepsi, along with other non-alcoholic beverages, will become costlier, with the GST Council on Wednesday approving a hike in tax rate on carbonated beverages to 40 per cent from 28 per cent at present.

As part of the reforms of the Goods and Services Tax (GST), the council increased the rate on carbonated beverages of fruit drink or carbonated beverages with fruit juice to 40 per cent from 28 per cent.

The government had proposed completely exempting life and health insurance premium from Goods and Services Tax (GST), Bihar Deputy Chief Minister and convenor of insurance GoM Samrat Choudhary had said earlier.

Health and term insurance premiums may become cheaper if the GST Council approves rate cuts at its meeting, said analysts.

However, according to a report by HSBC Securities and Capital Markets (India), insurance companies are likely to face short-term pressure on profitability due to slower repricing of existing policies.

HSBC’s analysis suggests that a full exemption could reduce health insurance premiums by around 15 per cent. Even a moderate 6 per cent rate cut under the 12 per cent GST with ITC scenario could ease costs for policyholders.

However, the government may face a revenue shortfall of USD 1.2-1.4 billion annually from GST on premiums if exemptions are granted, noted the report.

While lower premiums are expected to boost demand, insurance companies could see a 3-6 per cent impact on combined ratios (CR) in the retail health segment, primarily due to slower repricing of renewals which may take 12-18 months.

The expense ratios of insurers will also play an important role in determining transmission depending if ITC is available or not.

“Standalone health insurers would see a relatively higher impact than multi-line insurers, largely on high exposure to retail health,” noted the report, though growth prospects improve in the long run.

“We think a large part of the impact would be transitionary due to slower back book repricing,” the report added.

The report concludes that GST cuts, if implemented, could bring long-term gains for both insurers and consumers, despite short-term margin pressures. Improved affordability may encourage more households to purchase health cover, supporting broader financial inclusion goals.

welcome relief for policyholders! With GST on retail Life & Health insurance premiums removed, every rupee now goes directly towards securing families’ health and future. Great step by the government towards making insurance more affordable and accessible.

Happy to know the GST Exemption on individual life and health Insurance. It should go to the end users i.e., policy holders. Govt. Should monitor through IRDA.

Excellent decision taken by government Its very use full to our people purchasing capacity growth