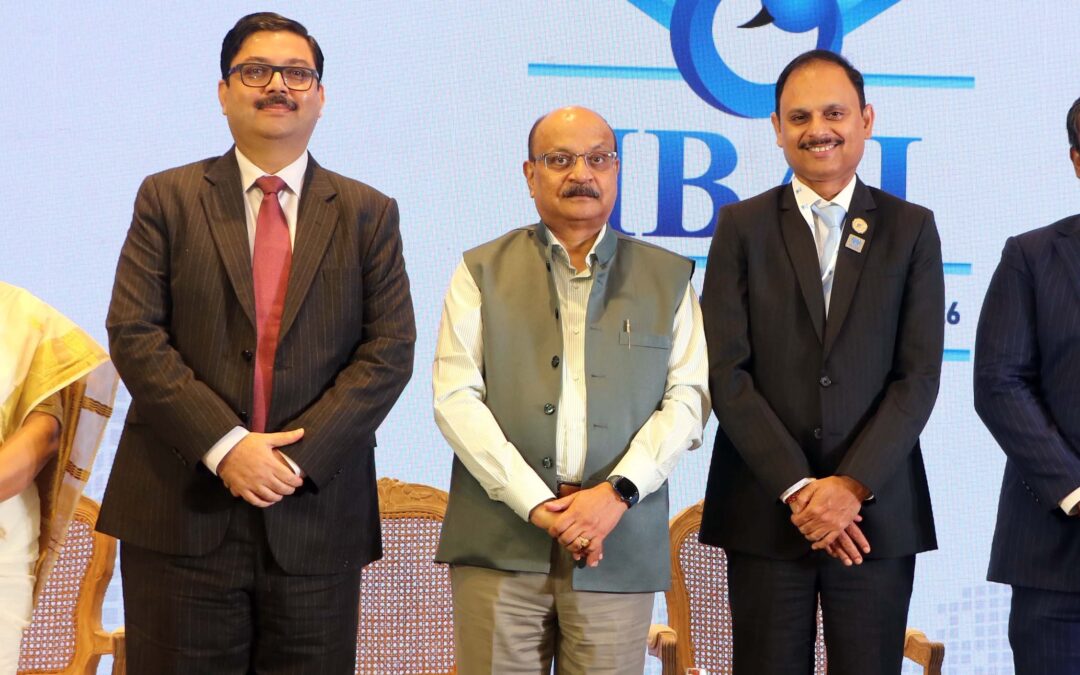

Girija Subramaniam, CMD, New India Assurance Rakesh Jain, CEO, Reliance General Insurance,Satyajit Tripathy, member, Distribution, IRDAI , Naveen Chandra Jha, MD & CEO, SBI General Insurance, Abhilash Sridharan, Partner, McKinsey & Company at a panel discussion in Mumbai on the occasion of 24th Foundation Day of Insurance Brokers Association of India

“ For covering missing middle, remuneration of insurance intermediaries should be moderated keeping in mind the issue of affordability and the larger interest of insurance penetration. The government also has to ensure some income for the insurance companies which are implementing its schemes as they are commercial entities,” stressed Girija Subramanian,CMD, New India Assurance

Mumbai: Satyajit Tripathy, member, Distribution, IRDAI on Friday said the Indian insurance broking industry is seeing increasing interest from foreign investors and players in the segment should pull up their socks to ensure governance standards are high and business ethics are maintained.

He further cautioned the insurance brokers not to adopt sharp practices to increase valuation, get listed to do business which may in the long run prove detrimental to the whole ecosystem.

Tripathy was addressing Insurance Brokers Association of India (IBAI) in Mumbai on its its 24th Foundation Day.

Many of the institutions and others in the insurance distribution space have started to look into the value created by them. This is backed by record activities in merger and acquisition, and demerger in the segment. We are seeing increasing interest of foreign direct investment in this sector. The regulator is seeing day by day increased activities in this area, stated Tripathy.

“While this is fine by all means, I must add a word of caution that with increased growth being seen, we need not be adopting what we call as sharp practices to increase valuation, get listed, and to do business in a way, which may in the long run prove detrimental to the whole ecosystem. It is time for the intermediary space to pull up their socks and also to see that to create long-term value in their own setup.”

According to Tripathy, the insurance brokers have to nurture talents and look into those aspects of business where governance standards are high, business ethics are maintained, and last but not the least, grow and let others grow also.

On the regulatory part, the IRDAI is envisaging a lot of changes in the distribution space and intends to unveil a few measures for pushing growth in the industry, hinted Tripathy.

“Now that a new chairman will be joining us soon we want to launch measures so that distribution changes are brought about in the market. You will find a lot of flexibility, a congenial atmosphere to grow, and to increase your business not only in the country but overseas also.”

“If we compare ourselves by the world standards, we have still some way to go. And if we have established a Gift city, we are seeing increased activity across the borders,” he said.

“ The policy makers are serious about insurance industry. Their main concern is how reach out to large section of people and small and medium enterprises(SME) who have not been covered but get hit most incase of mishaps and disasters. The government wants insurers and intermediaries to reach out to at every level including panjchyat, district and state. It is not any more top to bottom but otyherwise,”

“While, we welcome foreign direct investment into this sector, we also want to see that Indian intermediaries also grow significantly and are in a position to acquire business overseas also,” he exhorted.

Participating in a panel discussion on `Vision 2047 and Way Forward’ at the event, Girija Subramanian, CMD, New India Assurance, the largest general insurer in the country, said the government and policy makers have to be involved in achieving larger insurance penetration as the country and its citizens don’t have enough coverage.

“The missing middle and affordability of insurance products should be focus of the industry. Economic losses are far more than the insured losses and there is a huge protection gap in the country. Insurance entities particularly the insurance intermediaries should create awareness about covering missing middle, said Subramanian.

“ Also, for covering missing middle, remuneration of insurance intermediaries should be moderated keeping in mind the issue of affordability and the larger interest of insurance penetration. The government also has to ensure some income for the insurance companies which are implementing its schemes as they are commercial entities,” stressed Subramanian.

Naveen Jha, MD & CEO, SBI General Insurance, said,government’s financial inclusion programme now includes insurance that will help insurance penetration..

The industry should focus now more on rural and semi urban areas including Tier-ii and tier –III cities and Insurance For all by 2047 ‘ can be achieved by increasing awareness accessibility and affordability and .’’ he said adding that benefits out of the country’s economic position should be protected.

Rakesh Jain, MD & CEO, Reliance General Insurance Company, said,“ The insurance companies are well capitalised and have done well in the last 25 years. Per capita income of people in the country is increasing auguring well for the insurance industry. By 2027 per capital insurance spent can hit $300-$400.”

The basic issue is how do these insurers reach the segments of population who are bottom of pyramid. Whether it will be physical or digital and why it should be physical when the eco-system is becoming digital.

Going forward, there will be more digital employees, who will be smarter than physical employees. They will respond the way consumers are seeking things as the environment is turning into a consumer led risk assessment system.

If irda is keen on developing insurance industry, they should develop agency channel as it has proved it’s worth withe lic, examination system on recruitment of agency should be given to insurers or completely abolished, lic got development only because of this channel

This body has been doing nothing for the people. There are insurance companies not paying medical claims.

The government is enjoying 18% GST from customers and no services at all are provided by the government.

Nothing will happen.

This body sets high standards only on public platform but do nothing for common betterment. They all are aware of problems , outdated plans and service issues but still do nothing.

IRDAI and Govt regulations act like puppet. Insurance industry is dying in India as govt policies are not upto the mark. Govt not providing any insurance benefits also taking up the tax and benefits, giving boost to spending instead of saving.

As per offical data, India saving structure changed in last 5 years, saving habit came down from 24% to 19% in last 5 years and Govt is silent on this.

IRDA should modify a policy that it must be essential for Insurance companies to guide Senior Citizens not to buy ULIP of 15 years paying terms. And annuity of any policy should not be more than 20% of their annual earning (say pension). Any such Applications should undergo a scrutiny of senior managers. I came across two such cases when the senior citizens were misguided to buy policies with high paying premium and they got stuck.