Thomas Blunck, CEO, Reinsurance, Munich Re: “As digitalization advances, cyber protection against one of the biggest threats to economy and society is becoming more and more important. And yet, a large number of organizations lack adequate safeguards and coverage. Munich Re strives to reach the still un- and underinsured, we aim to increase cyber resilience and progressively close a critical protection gap”

Munich: Munich Re, the largest global reinsurer, expected the global cyber insurance market to reach USD 16.3bn in 2025.

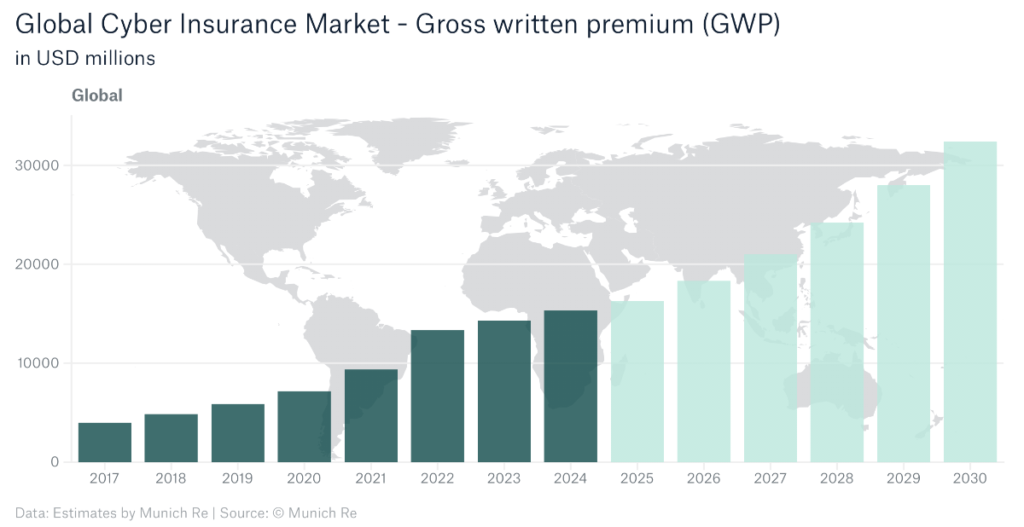

Munich Re estimated the global cyber insurance market totaled USD 15.3bn in 2024. This corresponds to less than 1% of the global premium volume for Property and Casualty insurance in 2024, which underscores the enormous potential for the insurance industry going forward.

Although cyber premium growth slowed in the past two years, Munich Re’s experts expected the global premium volume to more than double by 2030, growing at an average annual growth rate of more than 10%.

To date, the market has proven itself to be capable and efficient in sheltering those insured critical digital assets needed to run the daily operations of organizations of all types and sizes – from micro-, small- or medium-sized businesses to large corporate enterprises.

The global insurance industry can withstand multiple extreme cyber exposure scenarios, such as those that may arise from widespread malware attacks or large-scale outages of cloud service providers. Rapid, simultaneous risk changes due to technological, geopolitical and market-specific factors present insurers with both challenges and opportunities.

Stefan Golling, Board of Management member responsible for Global Clients and North America said “In today’s technology-dependent world, organizations can only be successful if they strengthen their digital defenses with robust, multi-layered risk management. Cyber insurance is an effective component in this approach.”

Thomas Blunck, CEO Reinsurance: “As digitalization advances, cyber protection against one of the biggest threats to economy and society is becoming more and more important. And yet, a large number of organizations lack adequate safeguards and coverage. Munich Re strives to reach the still un- and underinsured, we aim to increase cyber resilience and progressively close a critical protection gap.”

According to Munich Re, the global cyber insurance market is further maturing and is stable. This S&P Global Ratings’ assessment recognizes solid profitability of risk coverage over the past two years and its expected trajectory in 2025, despite increased competition and a rise in sophistication, severity and frequency of cyber-attacks in a more hostile environment.

The insurance market offers reliable capacity for commercial and private cyber policies. Rate increases, which boosted growth particularly in 2021 and 2022, have now led to a period of stabilization.

However, the cyber insurance market is set to experience steady growth in the medium term, driven by the increasing digitization of businesses across all segments, more frequent and severe cyber events, digital interdependencies and heavier regulation.