“I wish to say this for the due consideration of the bank boards , sale of insurance by banks has raised concerns of instances of mis-selling and I would say this has contributed indirectly to cost of borrowing for the customers . So banks will have to look at this , look at their core banking activities and not burden customers with insurances they don’t require,” Finance Minister Nirmala Sitharaman

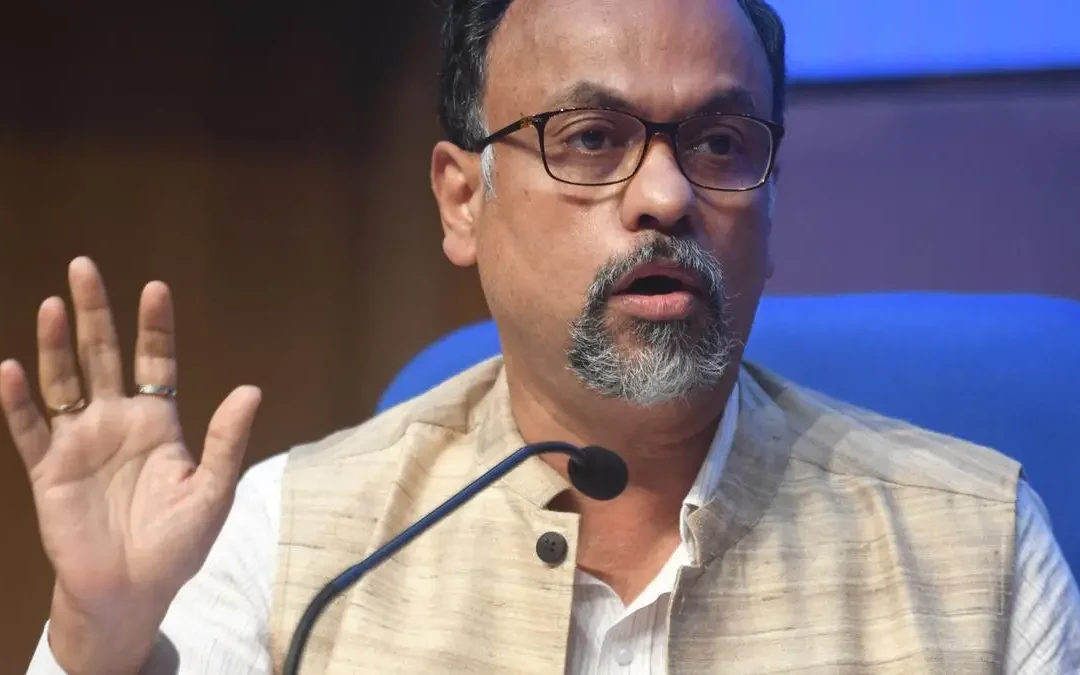

Mumbai: A day after Finance Minister Nirmala Sitharaman raised concerns over mis-selling of insurance by banks, Insurance industry regulator Irdai’s Chairman Debasis Panda on Tuesday urged bankers to focus on their core job and not pedal insurance alone.

“I wish to say this for the due consideration of the bank boards , sale of insurance by banks has raised concerns of instances of mis-selling and I would say this has contributed indirectly to cost of borrowing for the customers . So banks will have to look at this , look at their core banking activities and not burden customers with insurances they don’t require,” Sitharaman had said yesterday at the annual banking and economy conclave organised by SBI here.

Sitharaman had asked bankers to focus on their core jobs and avoid mis-selling of insurance policies, pointing that many a time, this also indirectly leads to increasing the cost of borrowing for a bank customer.

Making similar suggestions, Panda said the bancassurance channel is very useful in deepening the reach of insurance in the country.

“There is merit in the system but we have to do it with care and caution so that you don’t forget your activity and only start selling insurance. It should be incidental,” Panda said at the same event.

Insurance companies definitely need low-cost distribution solutions like the ones offered by the banks, which have a massive spread across the country and cover nearly all the inhabited places, he said.

“The banca channel is a very useful channel. But of late, a lot of ills have crept into the system. We all need to sit together, thrash out that, restore that confidence,” Panda said, adding that there is “mis-selling” as well.

It can be noted that most of the major banks have promoted insurance companies, and earn fat commissions from selling insurance covers which makes it a lucrative business.

Meanwhile, Panda reiterated a Viksit Bharat is one where everyone is fully covered and all the stakeholders need to be working towards the same.

The Irdai has put in place a forward looking regulatory system with operational flexibilities to all the players with that focus in mind, Panda said, adding that the regulator’s job is varied.

Irdai needs to maintain financial stability, protect the policyholders’ funds at all points of time and make sure that the insurers deliver on promises, he said.

It is also moving towards an enhanced risk management framework under which the industry will shift away from the factor-based risk management framework which looks at only liabilities, to one where both liabilities and capital buffers are taken into consideration to ensure that an entity remains solvent at any point of time, he said.