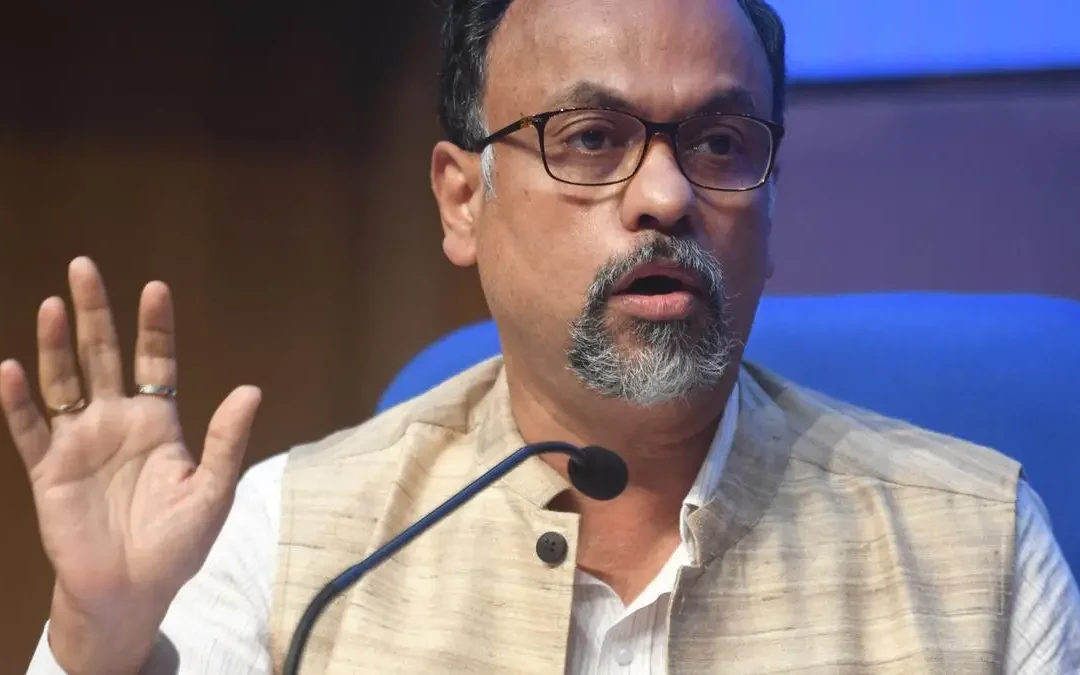

“And if the FDI route is also opened that will only augment the domestic investment as well, otherwise, domestic investment may get crowded out. … perhaps its time to open up for 100 per cent FDI so more players who want to come and operate on their own terms without trying to look for an Indian partner that may also help,” Irdai Chairman Debasish Panda

Mumbai: Irdai Chairman Debasish Panda on Friday pitched for 100 per cent foreign direct investment(FDI) in the insurance sector, saying a lot of capital is needed to achieve the goal of ‘insurance for all’ by 2027.

Speaking at an event of a business daily, Panda said insurance is a capital-intensive sector, and the country would need more players in the segment to increase insurance penetration.

India gradually started opening the insurance sector by allowing private and foreign investment in 2000. Currently, up to 74 per cent FDI is permitted in general, life and health insurance.

“We need a lot of capital, which means we need a lot of new entities to come in. There may be some consolidation also happening. So, all of that churning will happen.

“And if the FDI route is also opened that will only augment the domestic investment as well, otherwise, domestic investment may get crowded out. … perhaps its time to open up for 100 per cent FDI so more players who want to come and operate on their own terms without trying to look for an Indian partner that may also help,” he said.

Panda further said achieving universal insurance will be crucial in India’s journey towards a ‘Viksit Bharat’ by 2047.

He also said the digital platform Bima Sugam, an initiative of Irdai, will be instrumental in revolutionising the insurance sector by acting as a comprehensive public infrastructure for policyholders.

According to him, the initiative will empower customers to explore a variety of products in one marketplace, independent of intermediaries tied to specific companies, while also allowing distributors to conduct transactions more efficiently.