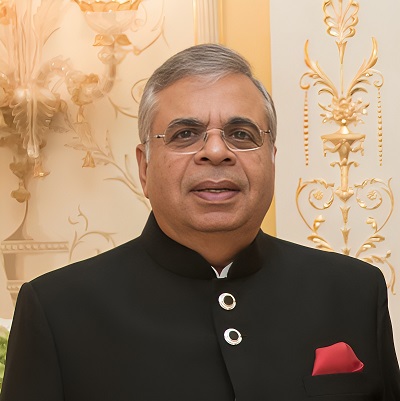

Ashok Hinduja, chairman, IndusInd International Holdings Limited ,

The IRDAI’s clearance for the deal has come now and with the IRDAI’s approvals in place, it is possible to stick to the earlier dead line of May 27 for the completion of acquisition of RCL, with two performing insurance subsidiaries- Reliance General Insurance and Reliance Nippon Life Insurance and a defunct health insurance company.by Hinduja group, said reliable sources

Hyderabad:

Finally, almost a year long battle of Hinduja Group to take over loss making Reliance Capital Limited, formerly an Anil Ambani company, is drawing to a close.

The Indian insurance regulator IRDAI, after initial objections, has quickly given its nod to the revised resolution plans of a consortium of companies, promoted by Hindujas, to take over debt laden Reliance Capital Limited, which has two performing insurance subsidiaries- Reliance General Insurance and Reliance Nippon Life Insurance and a defunct health insurance company. under the insolvency and bankruptcy code.

Nippon Life has 49 per cent in Reliance Nippon Life Insurance.

The approval is valid for three months and subject to certain “regulatory, statutory, and judicial clearances/compliances”. Further, IRDAI has also sought details of the share transfer post the completion of the acquisition.

“The shares of the insurer shall not be pledged or encumbered” without the regulator’s approval, said the IRDAI.

The IRDAI’s clearance for the deal has come now and with the IRDAI’s approvals in place, it is possible to stick to the earlier dead line of May 27 for completing the acquisition of RCL by Hinduja group of companies, said reliable sources.

“We are happy to acknowledge the receipt of approval from IRDAI on 10th May 2024 on the auspicious occasion of Akshay Tritiya. The approval is subject to certain ‘regulatory, statutory, and judicial’ clearances/compliances. Our company IndusInd International Holdings Limited (IIHL)stands committed to working towards obtaining the same as soon as possible and aims to close this transaction by the National Company Law Tribunal’s (NCLT) stipulated date of the 27th of May 2024. We take this opportunity to thank all stakeholders including regulators and the administrator for their timely support,” said spokesperson of Hinduja group promoted IIHL.

Earlier, on May 7, in a bid to overcome issues with the Indian insurance regulator IRDAI, Hinduja group had set up four new Indian companies for the regulatory compliance that would facilitate group’s acquisition of RCL.

The National Company Law Tribunal(NCLT) in February 2024 had allowed Hinduja group promoted IIHL to acquire RCL by paying Rs 9,650 to the lenders including Life Insurance Corporation(LIC).

Afterwards IIHL, a Mauritius base special holding company and another Hinduja promoted Indian entity Aasia Enterprises, had submitted a proposal seeking approvals of regulators like IRDA , Reserve Bank of India(RBI), Sebi and the Competition Commission of India(CCI) to complete the deal.

Except the IRDAI, rest of the regulators had cleared the deal.

The IRDAI, as part of its due diligence process, had raised several fundamental issues concerning the foreign shareholding of IIHL and fund raising plans of Hinduja group by making use of shares of RCL’s insurance subsidiaries.

Responding to IRDAI’s objections, Hinduja Group had submitted a new plan changing the entire corporate structure of the transaction for the implementation of the resolution plan which again was submitted to all the regulators for their fresh approvals.

The NCLT, earlier had set a date of May 27 to complete the transaction provided Hinduja group get all regulatory clearances from the regulators for acquiring RCL.

Hinduja group, instead of the routing the deal through IIHL, in a revised plan had introduced four new Indian companies namely, Cyqure India Private Limited, Ecopolis Properties Private Limited, Cyqurex Technologies Private Limited, and IIHL BFSI Holding Limited, for undertaking the transaction.

According to IIHL,Cyqure India will act as the holding company of Aasia as it will hold a majority stake in Aasia Enterprises, and its shareholders will be the same as that of partners of Aasia -Ashok Hinduja, Harsha Hinduja, and Shom Hinduja.

Besides this, the other two new companies, Cyqurex Technologies and Ecopolis Properties will be the 100 per cent subsidiaries of Aasia Enterprises.

The fourth newly introduced and incorporated company, IIHL BFSI Holding Ltd will be 100 per cent owned by IIHL.

In the revised corporate structure, IIHL will establish a subsidiary, IIHL BFSI Holdings (Mauritius), in which it will hold 51 per cent, while other new group companies will collectively hold the remaining 49 per cent. IIHL BFSI (Mauritius) will form a 100 per cent subsidiary, IIHL BFSI (India) Ltd, which, in turn, will hold a 100 per cent stake in Reliance Capital.

In the new scheme of things, Reliance Capital will hold 74 per cent of Reliance General Insurance and Reliance Health Insurance and the balance 26 per cent will be held by Aasia Enterprise which will also 26 per cent in Reliance Nippon Life Insurance, Reliance Capital will retain 25 per cent .

With the IRDAI approvals for all major changes in the entire corporate structure, the 27 May deadline seems to be possible now as the getting green signals from other regulators, which had already approved it, are a matter of formalities, said sources.

“The funding of Rs 9,650 crore will have 25 per cent of equity, 75 of debt. If tomorrow, I get the approval from the IRDAI, I will be ready in 48 hours, within the 27th of May, to make the payment,’’ Ashok Hinduja, chairman, IIHL had said at a recent media meet.

Apart from expanding the existing life and general insurance business of the insolvent RCL, Hinduja group’s IIHL will be keen to revive its defunct health Insurance company, Hindujahad said while announcing the company’s ambitious plans to achieve a valuation of $50 billion by 2030 after acquiring RCL.

EPFO, LIC and other provident funds own over 50 per cent of the total debt of Reliance Capital.

“The funding of Rs 9,650 crore will have 25 per cent of equity, 75 of debt. If tomorrow, I get the approval from the IRDAI, I will be ready in 48 hours, within the 27th of May, to make the payment,’’ Hinduja had said.

The NCLT on February 27, 2024, approved Hinduja Group firm IIHL’s Rs 9,650-crore resolution plan for Reliance Capital.

In June 2023, the Hinduja Group firm was selected by the committee for its bid of Rs 9,661 crore upfront cash and the deal was ratified by the NCLT on Feb 27. Reliance Capital’s cash balance of an additional Rs 500 crore would also go to the lenders.

In November 2021, the RBI superseded the board of Reliance Capital on governance issues and payment defaults by the Anil Dhirubhai Ambani Group company.

The central bank had appointed Nageswara Rao Y as the administrator, who invited bids in February 2022 to take over the company.