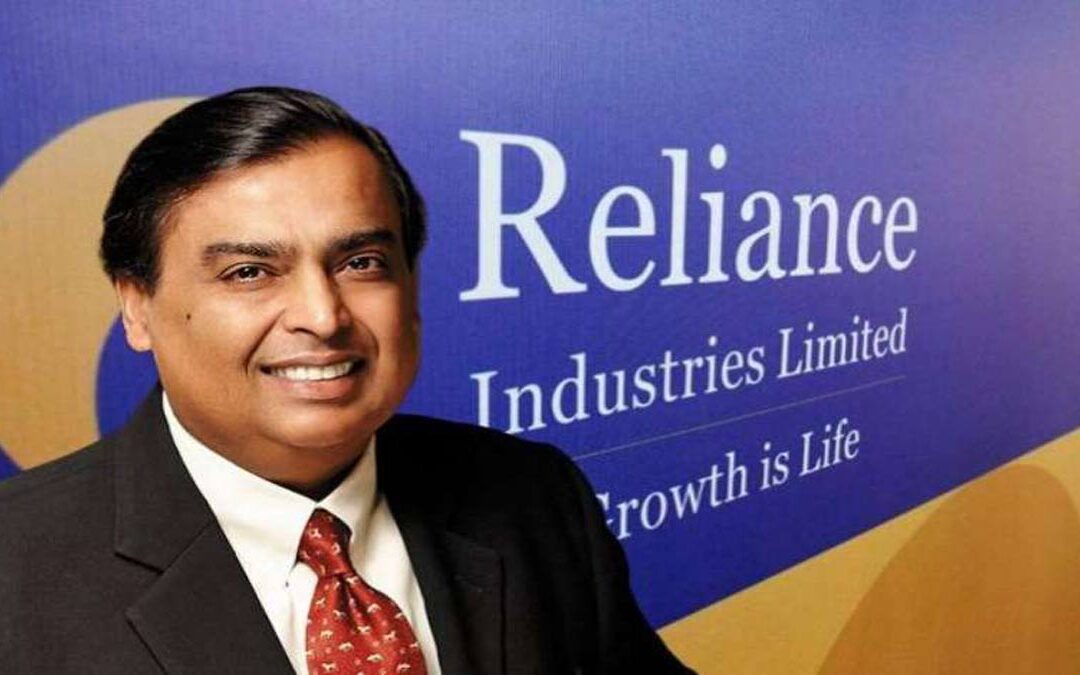

`JFS will enter the insurance segment to offer simple, yet smart, Life, General, and Health insurance products through a seamless digital interface, potentially partnering with global players. It will use predictive data analytics to co-create contextual products with partners and cater to customer requirements in a truly unique way, said Mukesh Ambani, chairman, Reliance Industries Limited at the company’s 46th annual general meeting In Mumbai on Monday

Mumbai:

Mukesh Ambani owned Jio Financial Services (JFS), after getting hived off from its parent company -Reliance Industries Limited- as a separate subsidiary, is set to enter the insurance sector and will offer life, general and health insurance products along with other segments in the financial sector services.

“JFS will enter the insurance segment to offer simple, yet smart, Life, General, and Health insurance products through a seamless digital interface, potentially partnering with global players. It will use predictive data analytics to co-create contextual products with partners and cater to customer requirements in a truly unique way, said Ambani at the RIL’s 46th annual general meeting on Monday.

There are speculations that JFS may tie up Warren Buffet’s Berkshier Hathway for its non-life venture and is also actively considering acquisition route rather than applying for new licenses to enter the sector.

However, it has not been possible to get any confirmations on both the issues from the company.

JFS plans to democratise financial services for 1.42 billion Indians, giving them access to simple, affordable, innovative, and intuitive products and services, This approach aims to address customer requirements in a unique and personalised manner, redefining the insurance landscape in India, added Ambani.

Jio Financial Services was recently listed on the stock exchanges on August 21.

According to Ambani, the financial sector is a highly capital-intensive business.RIL has provided JFS with a strong capital foundation to build a best-in-class, trusted financial services enterprise and achieve rapid growth. RIL has capitalised JFS with a net worth of Rs 1,20,000 crore to create one of the world’s highest capitalised financial service platforms at inception.

“Just like Jio and Retail, JFS too will prove to be an invaluable addition to the Reliance ecosystem of customer-facing businesses. I have three reasons to be absolutely confident about JFS achieving tremendous success over the next few years,” said Ambani.

The digital-first architecture of JFS will give it an unmatched head start to reach millions of Indians. JFS is blessed with a very strong board, led by K.V. Kamath, a veteran and most respected banker. A highly motivated leadership team is being built with a combination of financial industry experts and young leaders who are eager to take on big challenges, he elaborated.

in payments, JFS will consolidate its payments infrastructure with a ubiquitous offering for both consumers and merchants, further driving digital payment adoption for India. JFS products will not just compete with current industry benchmarks but also explore path-breaking features such as blockchain-based platforms and Central Bank Digital Currency( CBDC).They will adhere to the highest standards of security, regulatory norms and ensure protection of customer transaction data at all times.

On July 26, JFS and Blackrock agreed to form a 50:50 joint venture to create an asset management business called Jio BlackRock.