Battery packs can cost tens of thousands of dollars and account for up to 50% of an electric vehicle’s price, often making them uneconomical to replace.

“We’re buying electric cars for sustainability reasons,” said Matthew Avery, research director at Thatcham Research, an automotive risk education firm. “But an electric vehicle is not very sustainable if you have to throw away the battery after a small collision.”

LONDON/DETROIT:

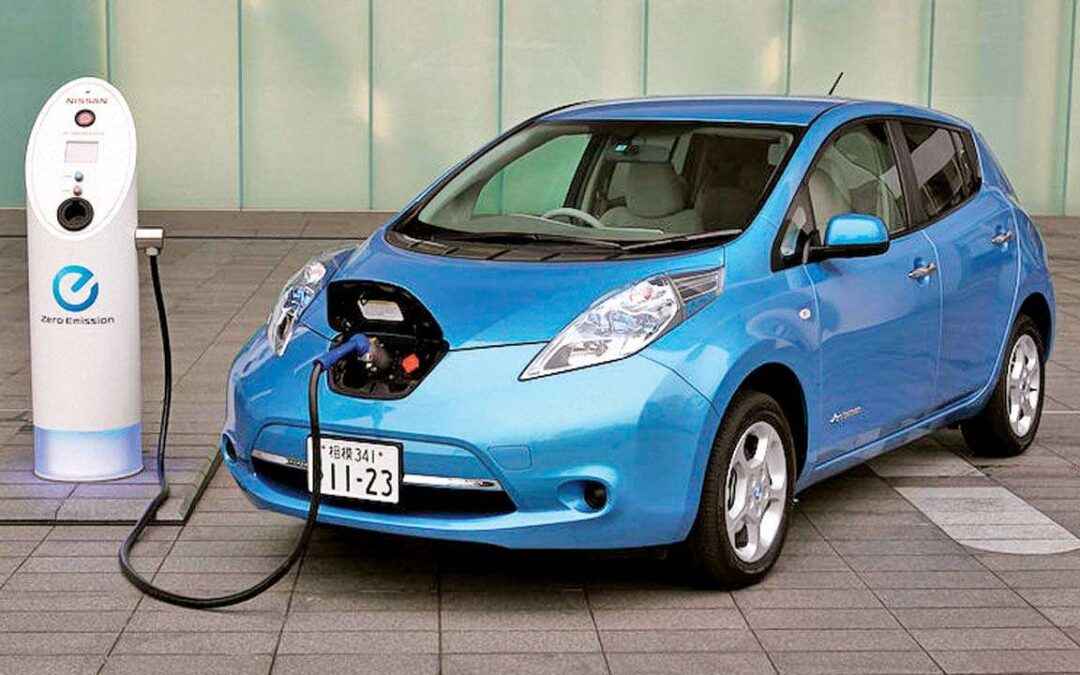

In many electric vehicles, there is no post-accident way to repair or assess even slightly damaged battery packs, forcing insurance companies to write off low-mileage cars – leading to higher premiums and undercutting Profits leads go electric.

And now, in some countries, those battery packs are piling up in scrapyards, a previously unreported and expensive loophole in a supposedly “circular economy.”

“We’re buying electric cars for sustainability reasons,” said Matthew Avery, research director at Thatcham Research, an automotive risk education firm. “But an electric vehicle is not very sustainable if you have to throw away the battery after a small collision.”

Battery packs can cost tens of thousands of dollars and account for up to 50% of an electric vehicle’s price, often making them uneconomical to replace.

While some automakers like Ford Motor Co and General Motors Co said they’d made battery pack repairs easier, Tesla Inc has taken the opposite path with its Texas-built Model Y The New structural battery pack has been described by experts as “zero repairable”.

Tesla did not respond to a request for comment.

A Reuters search of EV junk sales in the US and Europe shows a large proportion of low-mileage Teslas, but also models from Nissan Motor Co, Hyundai Motor Co , Stellantis, BMW, Renault and others.

EVs make up only a fraction of the vehicles on the road, making it difficult to obtain industry-wide data, but the trend for low-mileage, low-damage, zero-emission cars to be written off is growing.

Tesla’s decision to make battery packs “structural” — part of the car’s body — has allowed the company to reduce production costs, but risks pushing those costs back on consumers and insurers.

Tesla hasn’t mentioned any problems with insurers writing off its vehicles. But in January, CEO Elon Musk said that third-party insurance companies’ premiums were “unreasonably high in some cases.”

Unless Tesla and other automakers produce more easily repairable battery packs and give third parties access to battery cell data, already high insurance premiums will continue to rise as EV sales soar and more low-mileage cars are scrapped after collisions, insurers and industry experts said.

“The number of cases will increase, so handling batteries is a crucial point,” says Christoph Lauterwasser, Managing Director of the Allianz Center for Technology, a research institute of Allianz.

Lauterwasser pointed out that EV battery production emits far more CO2 than fossil-fuel models, meaning EVs have to be driven thousands of miles before they can offset those extra emissions.

“If you throw the vehicle away early, you pretty much lose any advantage in terms of CO2 emissions,” he said.

Most automakers said their battery packs are repairable, although few seem willing to share access to battery data. Insurers, leasing companies and car repair shops are already fighting with car manufacturers in the EU for access to lucrative connected car data.

Lauterwasser said accessing EV battery data is part of that fight. The Alliance has seen battered battery packs where the cells inside are likely undamaged, but without diagnostic data, they have to write these vehicles off.

Ford and GM are touting their newer, more repairable packages. But the new, large 4680 cells in the Model Y, which will be made at Tesla’s Austin, Texas plant, are glued into a package that’s part of the vehicle’s structure and can’t be easily removed or replaced, experts said.

In January, Musk said of Tesla the automaker has made design and software changes to its vehicles to reduce repair costs and insurance premiums.

The company also offers its own insurance product at lower rates to Tesla owners in a dozen U.S. states.

Insurers and industry experts are also finding that because electric vehicles are equipped with the latest safety features, they have had fewer accidents than conventional cars.

‘STRAIGHT TO THE LOOP’

Sandy Munro, head of Michigan-based Munro & Associates, which disassembles vehicles and advises automakers on how to improve them, said the Model Y’s battery pack has “no repairability.”

“A Tesla structural battery pack goes straight to the mill,” Munro said.

Electric vehicle battery problems also reveal a hole in the green “circular economy” touted by automakers.

At Synetiq, the UK’s largest salvage company, operations manager Michael Hill said the number of electric vehicles in isolation bay – where they must be checked to avoid fire hazards – at the company’s Doncaster site has risen by perhaps a dozen all over the past 12 months three days up to 20 per day.

“We’ve seen a really big shift, across all manufacturers,” Hill said.

The UK currently has no EV battery recycling facilities, so Synetiq has to remove batteries from depreciated cars and store them in containers. Hill estimates that at least 95% of the cells in hundreds of EV battery packs – and thousands of hybrid battery packs – that Synetiq has stored in Doncaster are undamaged and should be reused.

Most electric vehicles already cost more to insure than traditional cars.

According to online broker Policygenius, the average monthly insurance payment for electric vehicles in the US will be $206 in 2023, 27% more than for an internal combustion engine model.

According to Bankrate, an online financial content publisher, US insurers know that “if even a minor accident results in damage to the battery pack…the cost of replacing this key component can exceed $15,000.”

A replacement battery for a Tesla Model 3 can cost as much as $20,000 for a vehicle that retails for around $43,000 but quickly depreciates in value over time.

Andy Keane, UK product manager for commercial motor vehicles at French insurer AXA , said expensive replacement batteries “can sometimes make replacing a battery impossible”.

There is a growing number of garages that specialize in electric vehicle repairs and battery replacement. In Phoenix, Arizona, Gruber Motor Co has focused primarily on replacing batteries in older Tesla models.

But insurers don’t have access to Tesla’s battery data, so they’ve tread carefully, owner Peter Gruber said.

“An insurance company won’t take that risk because they’ll face a lawsuit later if something happens to that vehicle and they didn’t complete it,” he said.

‘PAIN POINTS’

The UK government is funding research on ‘pain points’ in EV insurance led by Thatcham, Synetiq and insurer LV=.

Recently passed EU battery regulations don’t specifically deal with battery repairs, but they called on the European Commission to promote standards to “facilitate maintenance, repair and reuse,” a commission source said.

Insurers said they know how to fix the problem — make batteries in smaller sections or modules that are easier to repair, and open up diagnostic data for third parties to determine battery cell health.

Individual US insurers declined to comment.

But Tony Cotto, director of auto and underwriting policies at the National Association of Mutual Insurance Companies, said, “Consumer access to vehicle-generated data will continue to improve driver safety and policyholder satisfaction… by facilitating the entire repair process.”

The lack of access to critical diagnostic data was raised in a class action lawsuit against Tesla in the US District Court in California in mid-March.

Insurers said inaction will cost consumers.

EV battery damage accounts for just a few percent of Allianz auto insurance claims, but 8% of claims costs in Germany, Lauterwasser said. Germany’s insurers bundle data on vehicle damage data and adjust premium rates annually.

“As the cost of a particular model goes up, the premium level goes up because the valuation goes up,” Lauterwasser said.

Reuters