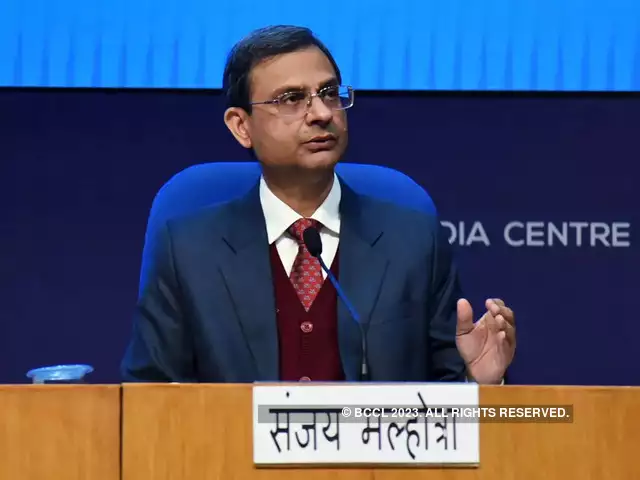

Sanjay Malhotra,Revenue Secretary

“I would also like to point out that the savings through tax exemptions is actually a very small portion of the total savings of our country, which are about Rs 25 lakh crore for households. Savings through tax (saving) instruments are only Rs 4 lakh crore. You know people are now investing otherwise,” Malhotra said at a CII post-budget event

New Delhi:

Household savings through tax saving instruments is just Rs 4 lakh crore, which is 16 per cent of total savings, and shifting to new tax regime won’t endanger the country’s savings rate, Revenue Secretary Sanjay Malhotra said on Friday.

He said the total household savings today are 27-30 per cent of India’s GDP and the schemes announced in budget, especially for senior citizens and women, will help the country in improving the savings rate.

“I would also like to point out that the savings through tax exemptions is actually a very small portion of the total savings of our country, which are about Rs 25 lakh crore for households. Savings through tax (saving) instruments are only Rs 4 lakh crore. You know people are now investing otherwise,” Malhotra said at a CII post-budget event.

To encourage taxpayers to shift to exemption-less tax regime, the Budget 2023-24 has proposed changes to the new optional tax regime which provides that no tax would be levied on annual income of up to Rs 7 lakh.

It also allowed taxpayers to claim standard deduction of Rs 50,000 — a move seen as a push for the salaried class to switch to the new tax regime where no exemptions on investments are provided.

Under the old regime, people with income of up to Rs 5 lakh do not pay any income tax. Besides, various deductions and exemptions can be claimed on savings and expenditures, making it lucrative for people to stay in old regime.

There were concerns that if people shift to exemption-less new tax regime, savings through insurance and other tax savings instruments will go down.

Malhotra also said the government is looking into rationalisation of tax deducted at source (TDS) provision.

“TDS is something that we need to look at it. Whatever scope there is to simplify it, to reduce the number of TDS rates or eliminate, we will certainly look at that,” he said.