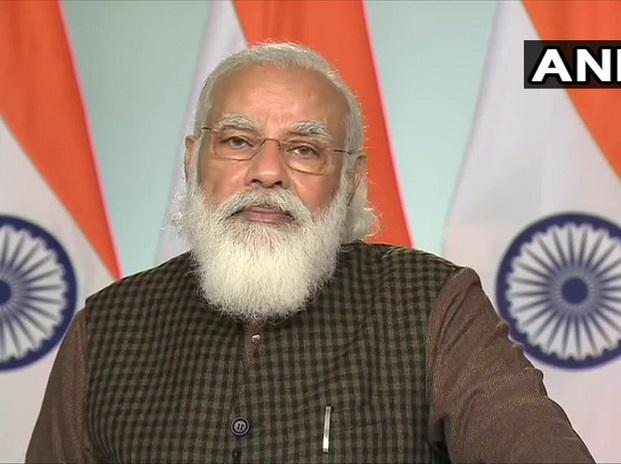

Prime Minister Narendra Modi

Experts opined that the economy is expected to see a strong recovery in the coming months and even go past the pre-COVID levels unless the pandemic plays spoilsport.

In the 2021 April-June quarter, the economy recorded a whopping 20.1 percent growth but then it came mainly on the back of the base effect as GDP contracted 24.4 percent in the year-ago period.

New Delhi:

Prime Minister Narendra Modi on Saturday said that the country’s economic growth rate is over 8 per cent.

Speaking at the release of the 10th installment of financial benefit under PM-KISAN, the Prime Minister said that the foreign investments, forex reserves, and GST collections are also at record high levels.

India needs to accelerate pace of its development in the new year and will not allow the challenges posed by the Covid-19 pandemic to dampen the growth process, Modi said .

“Today the growth rate of our economy is more than 8 per cent. Record foreign investment has come to India. Old records have also been broken in the GST collection. We have also set new paradigms in the matter of exports and especially agriculture,” said PM Modi. PM Modi said that it is time to start a “new vibrant journey” of the country’s resolves in the year India will complete 75 years of independence.

GST revenue collected in December 2021 was over Rs 1.29 trillion, 13 per cent higher than the same month last year, the Finance Ministry said on Saturday.

Though the collection was lower than Rs 1.31 trillion mopped up in November, December is the sixth month in a row when revenue from goods sold and services rendered stood at over Rs 1 trillion.

During the event, the Prime Minister also released an equity grant of more than Rs 14 crores to about 351 Farmer Producer Organizations (FPOs), which will benefit more than 1.24 lakh farmers.

After navigating the turbulent pandemic waves, the recovering Indian economy is now sailing through unchartered waters of rising coronavirus cases, spiraling commodity prices, and spiking inflation though the lighthouse of sustainable growth remains visible.

As 2022 begins, a raft of developments, ranging from Budgetary announcements to continuation of stimulus measures to monetary policy, will set the tone for the domestic economy, which is projected to grow more than 9 percent in the current fiscal ending March 2022, said experts

The country’s continuing massive vaccination drive and ‘precaution’ doses starting for select categories of people this month will provide a firewall against any steep spike in coronavirus cases amid the emergence of the Omicron variant.

Experts opined that the economy is expected to see a strong recovery in the coming months and even go past the pre-COVID levels unless the pandemic plays spoilsport.

In the 2021 April-June quarter, the economy recorded a whopping 20.1 percent growth but then it came mainly on the back of the base effect as GDP contracted 24.4 percent in the year-ago period.

Nevertheless, an 8.4 percent growth in the second quarter (July-September) was more meaningful as it indicated sustained recovery.

The country’s exports have picked up in recent months, which is also an indicator of substantial recovery in the economy.

Industry body Ficci President Sanjiv Mehta said that a likely growth of over nine per cent in the current fiscal ending March 2022 was good but more important would be to ”achieve a sustained growth of eight per cent over a long period of time”.

A sustained growth is needed for accelerating job creation, removing poverty and bringing in prosperity in the rural and semi-urban areas.

Fitch said it expects the services sector to show a strong reading amid the lifting of most restrictions.

”We have cut our FY22 (financial year ending March 2022) GDP growth forecast, to 8.4 per cent (-0.3 pp). GDP growth momentum should peak in FY23, at 10.3 per cent (+0.2 pp), boosted by a consumer-led recovery and the easing of supply disruptions,” the global rating agency said.

A dovish monetary policy by the Reserve Bank of India (RBI) has also played a key part in stimulating the overall economic activities. With global inflationary trends slightly on the upward trajectory, how long the RBI will continue with its relatively loose monetary policy will be closely watched by the markets.

The Reserve Bank has kept the benchmark lending rates or repo rates unchanged since May 2020. Among others, the low-interest rates have provided a much-needed boost to the real estate and other sectors of the economy.

”India’s real GDP bounced back strongly in Q2:2021-22, hitting a growth of 8.4 percent over a favorable base and exceeding the Reserve Bank’s estimates of 7.9 percent. The GDP level surpassed that of Q2:2019-20 by 0.3 percent,” according to an assessment by the RBI.

The recovery in aggregate demand remained broad-based in the Government Final Consumption Expenditure (GFCE), Gross Fixed Capital Formation (GFCF), and exports, it said.

The central bank noted that Private Final Consumption Expenditure (PFCE) too posted an uptick on a year-on-year basis due to a faster resumption of contact-intensive services and restoration of consumer confidence.

India’s exports continued to register an impressive recovery, emerging as a key driver of the higher growth trajectory, the RBI said.

With uncertainties galore, the Union Budget in February as well as the government’s fiscal approach and ambitious asset monetization plans will chart the future course of reforms path.