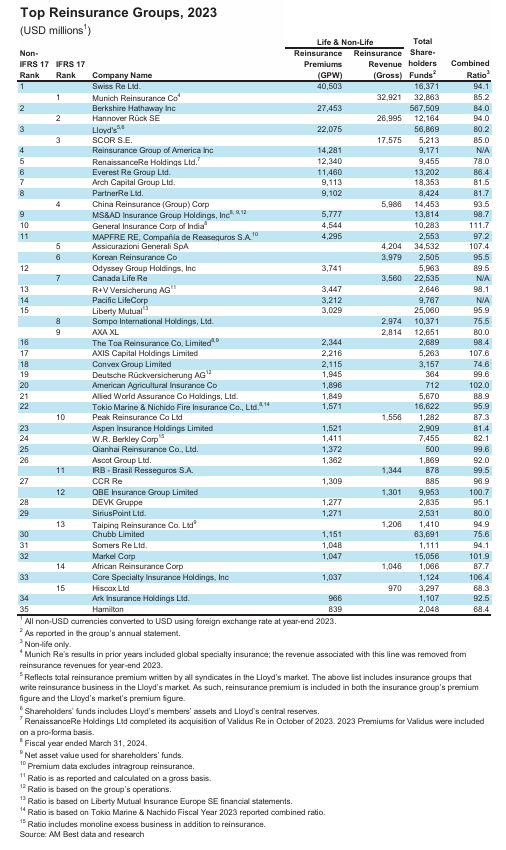

In AM Best’s `World’s 50 largest reinsurers in 2023’, Munich Re is the largest IFRS 17 reporting reinsurer followed by Hannover Re and SCOR Re. Swiss Re is the largest non-IFRS 17 reporting reinsurer globally, followed by Berkshire Hathaway and Lloyd’s

London/Mumbai: Getting a major boost, India’s state owned GIC Re has emerged as the 10th largest global reinsurer according to the new international ranking chart, released for 2023, by international rating agency AM Best ahead of annual Monte Carlo Rendezvous.

GIC Re, which has undertaken extensive restructuring of business in recent times to improve its rating and ranking, was the 16th largest global reinsurer in 2022.

AM Best on Thursday has released its latest list of `World’s 50 largest reinsurers’ , led by reinsurance majors like Munich Re, Swiss Re and Hannover Re, SCOR Re Berkshire Hathaway, taking in to account their performance in 2023.

Globally, Munich Re is the largest IFRS 17 reporting reinsurer followed by Hannover Re and SCOR Re.

Similarly, Swiss Re is the largest non-IFRS 17 reporting reinsurer globally, followed by Berkshire Hathaway and Lloyd’s.

Some of the other Asian reinsurers who are in the top-10 list are China Re and Korea Re at the fourth and sixth position respectively in IFRS category and Japanese major MS&AD at the ninth position in the non-IFRS category

The global reinsurance industry is in the midst of generational hard market that has driven the significant growth for many reinsurers. said AM Best which for the first time has revised its outlook for the global reinsurance segment to Positive from Stable.

Despite global investment market turmoil and severe global catastrophe losses, many reinsurers reported strong underwriting results , which was supplemented by significant growth in fixed –incomeinvestment yields, driven by increases in reinsurance rates .

Further it has said the transition to IFRS 17 diminishes the compatibility among reinsurers.

GIC Re

GIC Re’s gross premium income was at Rs 37,181.76 crore in FY 24 as compared to Rs 36,591.59 crore in FY 23. It has earned 69 per cent of its premium from the domestic market. GIC Re’s net profit was a record at Rs 6,497.30 crore in FY24 as compared to Rs 6312.50 crore in FY 23.

The reinsurer had expanded its premium base in Motor, Health, Marine Cargo and Life portfolios while reducing its exposure in Crop and Marine Hull business during FY24.

M Ramaswamy, CMD, GIC Re had earlier said the reinsurers is eagerly waiting for its new ratings by AM Best , which will be out shortly.

The new ratings, which is expected to be better than the existing one will help GIC Re to get quality business from overseas markets, he said.

Congratulations GIG Re and best of Luck😀