Headquartered in Mumbai, the entity would now be incorporated as a Section 8 (non-profit) company under the name ‘Bima Sugam India Federation’. The members of its interim board are are- Rakesh Joshi, former member, IRDAI, Naveen Tahilyani, MD&CEO, Tata Digital, Mahesh Balasubranian, MD& CEO, Kotak Life Insurance. Neerja Kapur, former CMD, New India Assurance has also been inducted as independent director

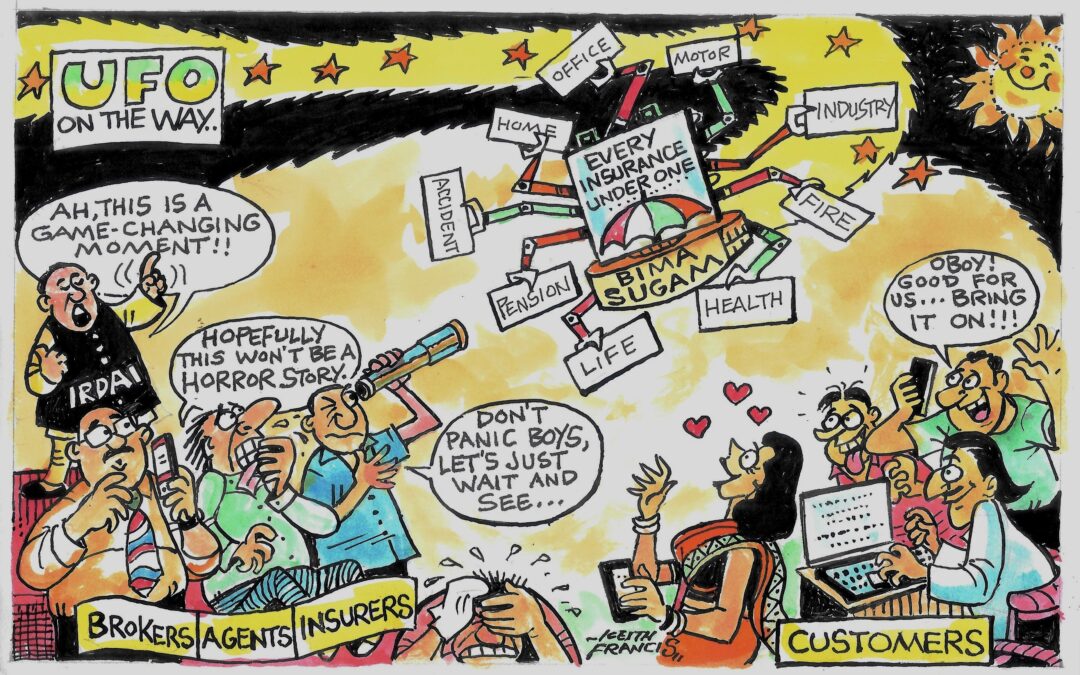

Mumbai: Putting implementation of the game changing Bima Sugam project on a fast track , an interim board has been formed, under the supervision of insurance regulator IRDAI, to oversea the progress of the entity, including formation of the company and appointment of a CEO, along with other key managerial personnel(KMP), by this month end.

The members of the board are- Rakesh Joshi, former member, IRDAI, Naveen Tahilyani, MD &CEO, Tata Digital, Mahesh Balasubranian, MD& CEO, Kotak Life Insurance.

Neerja Kapur, former CMD, New India Assurance has also been inducted as an independent director.

IRDI chairman Debasish Panda had met insurers on Thursday in Mumbai to take stock of the implementation of Bima Sugam project and `Cash less Everywhere’ in health insurance insurance.

One of the major milestones achieved in the meantime is the completion of the filing formalities for the incorporation of the Bima Sugam entity. The entity would now be incorporated as a Section 8 (non-profit) company under the name ‘Bima Sugam India Federation’, said General Insurance Council Council after the meeting .

Sources point out that couple of names have already been shortlisted for the appointment of a CEO for the Bima Sugam project by headhunter firm Executive Access.

An insurance committee headed by Neelesh Garg, MD & CEO, Tata AIG General Insurance, is supervising the implementation of the Bima Sugam project, which is expected to usher in the `UPI moment’ in the Indian insurance industry, till a company and a CEO are in place to take over the day to day functioning of this e-market place.

After the formation of the company, which will be headquartered in Mumbai , each of the insurers will contribute their share of the capital. Initially, a corpus of Rs 200 crore will be mobilized to get the project up and running.

Afterwards, more capital will be raised from the insurers if necessary.

Earlier, Panda had set a deadline of April 2025 for the Bima Sugam project to go live.

The consultant to the project, E&Y has been asked to chart out the final part of the Bima Sugam project for developing the e-market platform, along with the consultation of all stake holders.

Addressing the insurers, Panda stated that Bima Sugam is a revolutionary project for the Indian insurance sector and is poised to democratize and universalise insurance in India and possibly one of the first initiatives of its kind across the world.

The business structure of Bima Sugam and updates from various sub-groups, including operations and technology, were also reviewed in the meeting.

Earlier, laying down the broad principles for its high-tech move Bima Sugam, the IRDAI had said the Insurance Electronic Marketplace, established through a company formed under section 8 of the Companies Act, 2013, will be a not for profit entity.

“The successful incorporation of ‘Bima Sugam India Federation’ as a non-profit entity paves the way for appointing key leadership and finalizing the operational framework. This initiative embodies the power of technology and innovation to improve the insurance experience for all. The collective efforts of all stakeholders are critical, and we are confident that Bima Sugam platform will play a pivotal role in achieving ‘Insurance for All by 2047,” said Tapan Singhel, MD&CEO,Bajaj Allianz General Insurance.

Bima Sugam will enable individuals to buy a life, health, motor or property etc. insurance policy online. It will translate to easy access under a single roof for insurance companies, agents, brokers, banks and even aggregators.

This digital platform would also enable the intermediaries including agents to provide services to policyholders with no additional cost/investment for the agents/distribution partners.

Panda also impressed upon the insurers to implement the new health Insurance regulations, unveiled recently , in the overall frame work of Cashless Everywhere.

Excellent decision by the Authority,

The digital platform of BIMA SUGAM should be equally customer friendly in terms of cashless approval and claim SETTLEMENT whose time line MUST BE DEFINED WITH PENALTIES ON THE INSURANCE COMPANY IF THEY VIOLATE TIME LINE .

You can’t make a mountain out of mole hill.

This is my experience with Kotak Life.

Resignation has not been accepted even after 3 months and premium amount paid has not been returned even after three months as per Company rules.

I am not taking names only the originating branch is Kolkata , Kanak bldg and decision taking office Delhi.

No reply of reminders after reminders.

As this is a very new initiative, the writing should have been more objective and clear. After reading it thoroughly I am still not clear if it is an insurance service providing company, or a platform or a kind of regulator. It should have clearly spelt out the objective of such an entity, modus operandi and it’s jurisdiction.

For any life or health insurance policy, there must be medical check up to disclose all health issues. After check up there should be no scope for Pre-existing disease. Cashless benefit, time bound settlement area must.

Very dangerous for insurance agents

Need of the Hour. Should be expanded to more Areas desired.

State wise co-ordination and followup required for Good Results