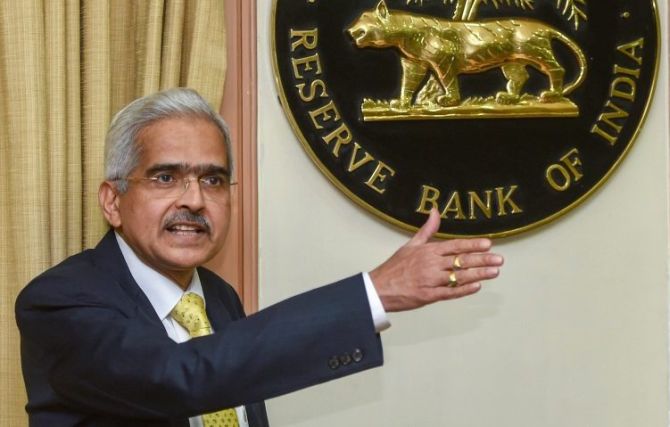

Shaktikanta Das, governor, RBI

The RBI’s monetary policy committee held the lending rate, or the repo rate, at 4%. The reverse repo rate, or the key borrowing rate, was also maintained at 3.35%

RBI governor Das said that the Indian economy is relatively well-positioned on the path of recovery.

“But it cannot be immune to global spillovers or to possible surges of infections from new mutations including the Omicron variant

MUMBAI:

The Reserve Bank of India’s monetary policy committee(MPC) kept its key lending rate steady at record lows on Wednesday, with investors awaiting its outlook on inflation and what steps it will take to withdraw surplus cash from the banking system.

The committee held the lending rate, or the repo rate, at 4%. The reverse repo rate, or the key borrowing rate, was also maintained at 3.35%.

Real GDP growth of the Indian economy retained at 9.5%, said, Shaktikanta Das, governor, RBI.

The central bank has retained its Inflation target at 5.3% for FY22.

“Indian economy hauled itself out of its deepest contraction; we are better prepared to deal with COVID-19,” said Das.

The domestic economy expanded 8.4 per cent in the September quarter from a year earlier, the fastest pace among major economies, but economists said disruptions from the new virus variant risked slowing the recovery.

Inflation has been within the RBI’s 2-6 per cent target range due to the cuts in taxes on fuel by central and local governments, but the damage to perishable food items due to unseasonal heavy rains and telecom price hikes are likely to push inflation up yet again.

Das said that the Indian economy is relatively well-positioned on the path of recovery.

“But it cannot be immune to global spillovers or to possible surges of infections from new mutations including the Omicron variant.

“Hence, fortifying our macroeconomic fundamentals, making our financial markets and institutions resilient and sound, and putting in place credible and consistent policies will assume the highest priority in these uncertain times,” he said.

Globally, he said economies are opening up and activity levels are reaching pre-pandemic levels.

“At the same time, the recurrence of Covid-19 waves in many parts of the world including the appearance of the Omicron variant, stubborn inflation and headwinds from continuing supply bottlenecks cast a shadow on the outlook.”

“Given the evolving growth-inflation dynamics across countries, monetary policy is also reaching an inflection point, keeping financial markets edgy.”

Besides, Das said that given the slack in the economy and the ongoing catching-up of activity, especially of private consumption, which is still below its pre-pandemic levels, continued policy support is warranted for a durable and broad-based recovery.

All 50 economists polled by Reuters had expected no change in the repo rate and they did not expect a change before the second half of 2022.

A quarter of 41 respondents surveyed on the reverse repo rate had predicted an increase.

Economists had priced in a small increase in the reverse repo rate – the rate at which the central bank borrows short-term funds from banks – as the RBI tries to normalise the gap between lending and borrowing rates to pre-COVID levels.

Churchil Bhatt, executive vice president,Debt Investments, Kotak Mahindra Life Insurance commented, in line with expectations, MPC left Policy Rates unchanged and persisted with accommodative stance citing uncertainty around the new Covid variant. Despite the upside pressures on core inflation, the MPC drew comfort from the excise duty cuts, expecting CPI inflation to peak in Q4FY22.”

“Subsequently, we expect MPC to start hiking reverse repo gradually beginning February 2022 policy. During this era of high uncertainty, this predictability in the path of monetary policy is of immense support to economic sentiments. Such slower than expected pace of policy normalization coupled with reduced RBI bond buying may signal a pause in recent trend of yield curve flattening. 10 Year Benchmark Gsec is expected to trade in 6.30% – 6.50% range in the near term,” he said.

On liquidity management front, RBI increased the quantum of existing VRRR (variable rate reverse repo) operations in a continuing effort to nudge the overnight rates higher towards repo rate, added Churchill..

Niraj Kumar, chief Investment Officer, Future Generali India Life Insurance, said,“MPC has reinforced that the overarching approach continues to be that of gradualism and would eliminate any element of surprises for the markets. MPC continues with gradual liquidity normalisation and stands ready to pitch in through operation twists and OMO’s to tame any untoward move in yields. Overall to sum up, this policy has not thrown any curveballs and the verdict has been well embraced by the markets.”

The central bank has slashed the repo rate by a total of 115 basis points (bps) since March 2020 to soften the blow from the coronavirus pandemic and tough containment measures. This follows 135 bps worth of rate cuts since the beginning of 2019.

However, with the onset of Covid-19 pandemic since March 2020,the Indian economy has been on a roller coaster. During April-June 2020 quarter, a period when the RBI last changed policy rates,

India’s GDP slumped by 24.4 per cent. The economy posted a growth of 20.1 per cent during April-June 2021 quarter. The GDP posted a growth of 8.4 per cent in July-September 2021 quarter as against a contraction of 7.4 per cent in the year-ago period. There has been a wide fluctuation in inflation also.

However, the RBI has maintained a ‘wait and watch” approach as these fluctuations have been guided by factors largely beyond its control.COVID-19 new strain Omicron, first identified by South African scientists, is seen as the next big potential source of uncertainties for India’s economy.

Omicron cases have been spreading fast in India. More than 20 cases have been reported in the last one week.