According to an official statement, ILO has acknowledged India's...

Category:

Pension & Social Security

Latest

FM asks financial sector regulators to standardise KYC, refund of unclaimed assets to rightful owners

Lto R--Ajay Seth, Finance secretary, Sanjay Malhotra, Governor,...

74% employees prioritise long-term benefits over bigger paychecks: Report

Around 74 per cent of employees interviewed stated that they would...

AP Govt to disburse hiked welfare pensions on July 1

N Chandrababu Naidu,Chief Minister,Andhra Pradesh Over 65 lakh beneficiaries under 28 categories will benefit. The new government has also increased pensions to eligible specially-abled persons from Rs 3,000 per month to Rs 6,000 per month Amaravati (Andhra Pradesh):...

IOA planning medical insurance and pension for former Olympians

"The IOA is committed to taking athlete-centric steps, and one of these is providing medical insurance and pension for all our ex-Olympians," IOA President and legendary athlete PT Usha said New Delhi: The Indian Olympic Association (IOA) is set to introduce...

EPFO adds highest-ever members in April since 2018

The share of women in the new members stood around 2.49 lakh out of total of 8.87 lakh new members, indicating a broader shift towards a more inclusive and diverse workforce. An increase of 31.29 per cent has been registered in net member addition during April as...

Atal Pension Yojana adds record 12.2 million new members in 2023-24

The government pension scheme achieved a growth of 24 per cent in gross enrolments at the end of FY 23-24 standing at 64.4 million. APY is rapidly gaining popularity among women and youth. In FY24, out of the total enrolments, 52 per cent were women and out of the...

Only 29% elderly people have access to social security schemes like Pensions, PF: Study

Health insurance coverage is limited to 31 per cent of the elderly New Delhi: Only 29 per cent elderly people reported to have access to social security schemes, such as old-age pensions or provident funds, according to a study by the NGO HelpAge. A similar proportion...

Norway sovereign wealth fund excludes Adani Ports from over ethical concerns

Norges said it decided to exclude Adani Ports due to "unacceptable risk that the company contributes to serious violations of individuals' rights in situations of war or conflict" Norway's central bank said on Wednesday that its executive board has decided to exclude...

EPFO evaluating course of action over HC ruling on foreign workers

India presently has social security agreements with 21 countries. These agreements ensure continued social security coverage for employees from these nations on a mutually reciprocal basis. When citizens from these countries take up employment in each other’s...

Developing Asia and the Pacific failed to secure well-being of aging population: ADB report

``Governments need to prepare now if they’re going to be able to help hundreds of millions of people in the region age well. Policies should support lifetime investment in health, education, skills, and financial preparedness for retirement. Family and social ties are...

India must expand Universal Health Coverage for ageing population, maintain economic growth: ADB Report

While the South Korea and Thailand have achieved universal health coverage, others lag behind with India having the lowest health insurance coverage among older people at 21 per cent, a report titled 'Aging Well In Asia' prepared by ADB said Tbilisi:India is one of...

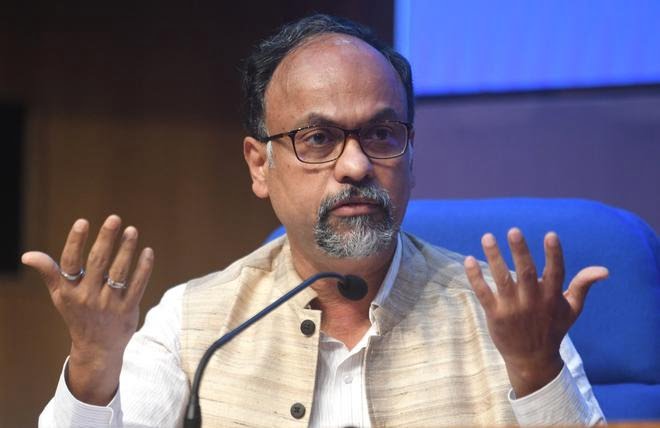

Bima Vistaar: IRDAI unveils premium for its mass combo cover at Rs 1500, for a family at Rs 2420

Debasish Panda, chairman,IRDAI Bima Vistaar will have a combined features of Life, Health, Personal accident and Property. For Life cover a premium of Rs 820 has to be paid while Health, Personal accident, Property have been priced at Rs 500, Rs 100 and Rs 80...