The initiative offers Central Government employees a unified...

Category:

Life

Latest

“Increase profitable biz,maintain market share and strengthen retail portfolios”DFS Secy to PSU insurers

Nagaraju also stressed that high priority should be given to the...

ICICI Pru Life reports a 20% rise in its Q3 profit to Rs 390 crore

`The recent '0% GST reform' on individual policies has...

Indian cos increasingly adopting AI-driven tools to streamline their hiring processes

Companies such as Paytm, Titan, Muthoot Fincorp, SBI Life Insurance, IDFC First Bank and HCL used the AI tool. New Delhi: As artificial intelligence continues to expand its footprint across sectors, companies are increasingly adopting AI-driven tools to streamline...

Hong Kong plans new crypto,infrastructure rules for insurers

The insurance regulator would impose a 100% risk charge on cryptoassets, according to a presentation on Dec. 4 seen by Bloomberg News. Stablecoin investments would attract risk charges based on the fiat currency the Hong Kong-regulated stablecoin is pegged to, the...

Life Insurance:India’s insured population jump from 15 crore to nearly 40 crore in a decade

Growth has been supported by increasing demand for group insurance, product innovation, personalised offerings, and stronger distribution networks, especially in individual insurance. New Delhi:The number of people covered by life insurance in India has risen sharply...

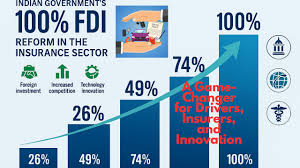

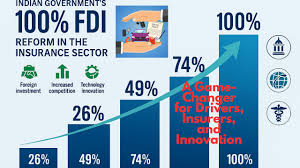

Govt notifies new Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Act, 2025, IRDAI to frame new regulations

Now, insurance regulator IRDAI will come out with new set of regulations in accordance with the new Act which provides a host of changes including hiking FDI from 74 per cent to 100 per cent for the Indian insurance companies The new Act introduces one-time...

Amendment of Insurance Laws Bill, 2025:Achieving “Insurance for All” by 2047

The Insurance Act 1938 did not contain any definition of “insurance business”. The Bill now seeks to define this term to mean the business of effecting insurance contracts, as well as any other form of contract that may be notified by the Central Government in...

100% FDI in Insurance:India’s big-bang financial reforms target wave of foreign money

All these reforms come as Prime Minister Narendra Modi and his administration want to make India a developed economy by 2047,a goal that requires economic growth of about 8% per year, and policymakers are betting on rapid industrialization and deeper capital markets...

Seth urges insurers on timely and effective resolution of policyholders’ grievances

``When a citizen takes the trouble to write a grievance,they are not filling a form—they are sending a signal that they need the system to listen. How we respond to that signal shapes trust not only in insurance, but in institutions themselves. Choose the customer...

Piramal Finance to exit Shriram Life, sells its 14.72 pc stake to Sanlam for Rs 600 cr

The transaction is expected to close in the quarter ending March 31, 2026, subject to receipt of the requisite regulatory approvals, including approval of the Insurance Regulatory and Development Authority of India, Piramal Finance said in a regulatory filing New...

Passage of Insurance Bill in Parliament to play catalytic role for sector growth: LIC Chief

The Bill provides a framework for greater operational agility and innovation, allowing insurers to design and distribute targeted products that cater to evolving insurance needs, including retirement security, longevity solutions, and health-linked protection,LIC CEO...

Insurance Amendment Bill, 2025: Reforms for Insurance Penetration in India

R Doraiswamy, CEO& MD, Life Insurandce Corporation The Bill also provides a framework for greater operational agility and innovation, enabling insurers to respond effectively to changing demographic, economic, and social realities. India’s insurance needs today...