Google admitted the arrangement had a substantial impact on...

Category:

Regulation

Latest

Cabinet approves bill to regulate online gaming platforms, real money games may face ban

Sources said that the decision has come following observations from...

GST rejig: Sitharaman to address Aug 20 GoM meet to put forth Centre’s rate cut proposal

Nirmala Sitharaman , Union Finance Minister The GoM on Life and...

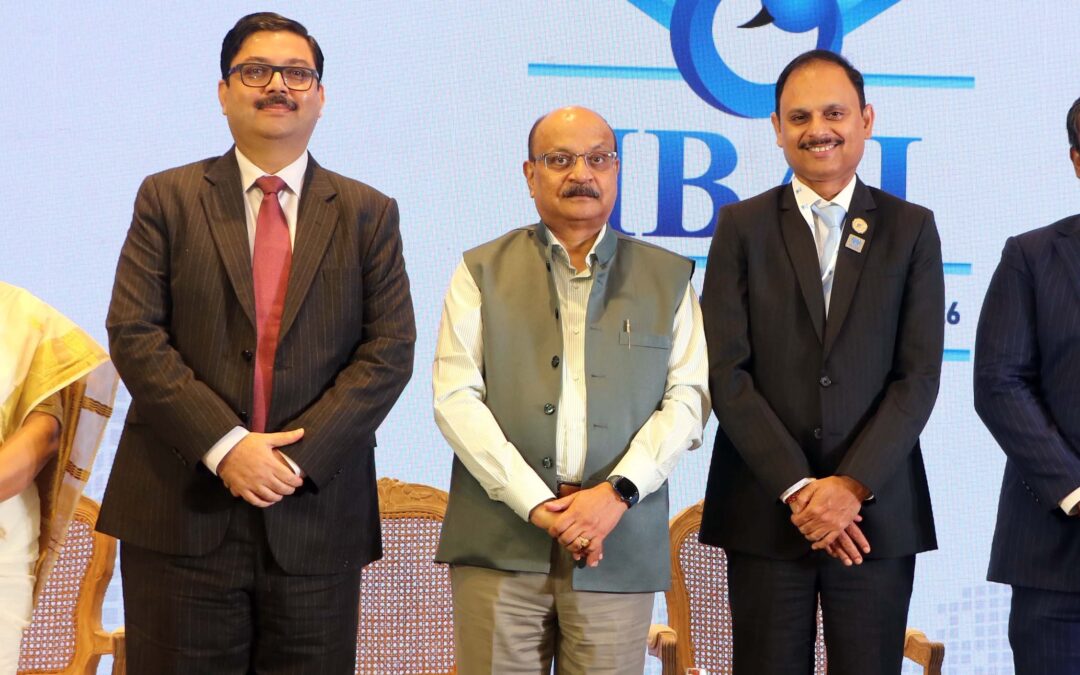

Insurance brokers should maintain high governance standards and business ethics: IRDAI member

Girija Subramaniam, CMD, New India Assurance Rakesh Jain, CEO, Reliance General Insurance,Satyajit Tripathy, member, Distribution, IRDAI , Naveen Chandra Jha, MD & CEO, SBI General Insurance, Abhilash Sridharan, Partner, McKinsey & Company at a panel...

IRDAI imposes a stiff penalty of Rs 3.39 crore on Star Health for violating cyber security laws

A significant data leak from Star Health Insurance was reported in Aug, 2024, affecting approximately 3.1 crore customer records. The data, including mobile numbers, PAN details, addresses, and medical information, was allegedly accessible through a website created by...

Former finance secy Ajay Seth appointed as new IRDAI chairman for 3 yrs

Ajay Seth, Chairman-designate, IRDAI Seth, a 1987-batch Indian Administrative Service(IAS) officer from the Karnataka cadre, retired in June end New Delhi: Finally, Ajay Seth, 60, former Finance Secretary, Ministry of Finance, has been appointed as the new chairman of...

Angel one forms Rs 400 crore life insurance JV with Singapore’s Livwell

Wilf Blackburn, ex-regional CEO of Prudential Asia, is proposed to chair the proposed venture, while Nikhil Verma, former deputy CEO of Aviva Vietnam, is proposed to lead as CEO Mumbai: Domestic brokerage Angel One on Wednesday announced a plan to partner Singapore's...

Irdai proposes internal ombudsman for insurers to address claims up to Rs 50 lakh

"Applicable to all insurers (except reinsurers) with more than three years of operations, the framework mandates the appointment of an internal insurance ombudsman to address complaints involving claims up to Rs 50 lakh," it said. New Delhi: Irdai on Wednesday...

India’s financial inclusion index improves, surges to 67 from 64.2 in March 2024: RBI

It captures the level of financial inclusion using data from different sectors, including banking, insurance, investments, pensions and postal services. Mumbai: The Reserve Bank of India (RBI) on Tuesday said that the country's financial inclusion index (FI-Index)...

TRAI convenes joint committee of regulators on issues of spam and cyber fraud

Key outcomes were urgent transition to 1600-Series for Commercial Calls, regulators, discussed setting up timelines for migration to the dedicated 1600-number series for transactional and service calls in the banking, financial services, and insurance (BFSI) sectors....

What’s in the EU’s 18th sanctions package against Russia?

Central to the package is a lower price cap on Russian oil – a move designed to shrink Moscow’s energy revenues without disrupting global markets by severing Russian supply entirely. Here are the details of the European Union’s 18th package of sanctions against Russia...

No Insurance Amendment Bill yet in Parliament’s Monsoon session

The government has already listed eight bills for their likely introduction and passage in the Monsoon session of the Parliament but there is no mention of the Insurance Amendment Bill in the list.The Ministry of finance officials earlier had...

ED summons Meta, Google officials in illegal betting case

The federal agency is probing multiple platforms hosting illegal betting and gambling links, including instances of advertisements placed for them on various Internet-based social media outlets and app stores. New Delhi: India's financial crime fighting agency, the...