M Nagaraju, Secretary, Financial Services Banks need to ensure that...

Category:

Banking & Bancassurance

Latest

Over 8.5 lakh mule accounts in 700 bank branches used by cyber criminals CBI

The CBI has found that these mule accounts -- established using...

Warburg Pincus in talks with Premji Invest and SBI to sell its 10 % stake in SBI General

A transaction could value SBI General Insurance at as much as $4.5...

IRDAI chief to meet insurance industry CEOs for Bima Sugam and Bima Manthan on Feb 12-14

Debasish Panda,chairman,IRDAI The IRDAI, on Feb 12, is expected to do a plain speaking to the insurers who have not taken their Bima Sugam job seriously. IRDAI chairman Debasish Panda will address CEOs of non-life insurance companies on 13th Feb and life companies...

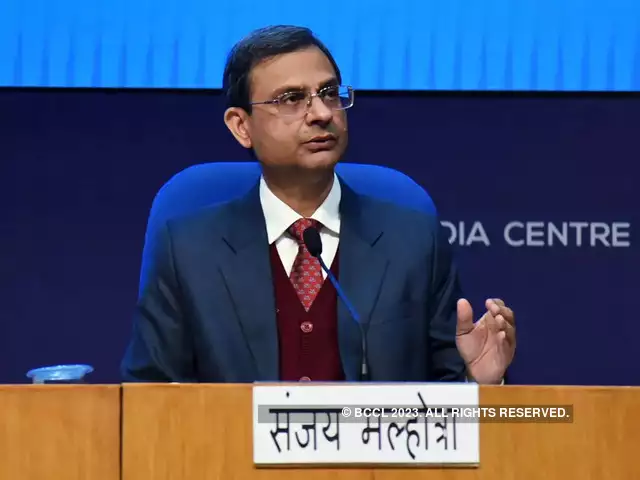

RBI allows insurers to deal with interest rate derivative products

``Such forward contracts will enable long-term investors such as insurance funds to manage their interest rate risk across interest rate cycles. They will also enable efficient pricing of derivatives that use bonds as underlying instruments,'' said Sanjay Malhotra,...

Cyber security: RBI introduces ‘bank.in’ as exclusive internet domain for Indian banks

With increased instances of fraud in digital payments becoming a significant concern, this initiative aims to reduce cyber security threats and malicious activities like phishing; and, streamline secure financial services, thereby enhancing trust in digital banking...

RBI cuts repo rate by 25 basis points to 6.25%,first in nearly 5 yrs

Sanjay Malhotra,Governor,Reserve Bank of India The Monetary Policy Committee (MPC), which consists of three RBI and three external members, favoured a rate cut to provide stimulus to the sluggish economy, which is expected to grow at its slowest pace in four years in...

RBI likely to cut repo rate by 25 basis points for 1st time in 5 years

The potential rate cut is coming after the domestic rate-setting panel has kept the policy repo rate unchanged for the last 11 consecutive meetings -- after raising it by 250 bps between May 2022 and February 2023 New Delhi: The Reserve Bank of India (RBI), in all...

RBI Guv asks banks to have robust systems to curb digital frauds

Sanjay Malhotra,Governor,RBI While dwelling upon IT risk management and cyber security, the governor urged banks to have enhanced oversight over third-party service providers for mitigation of the risks emanating from them, RBI said in a release Mumbai: Flagging the...

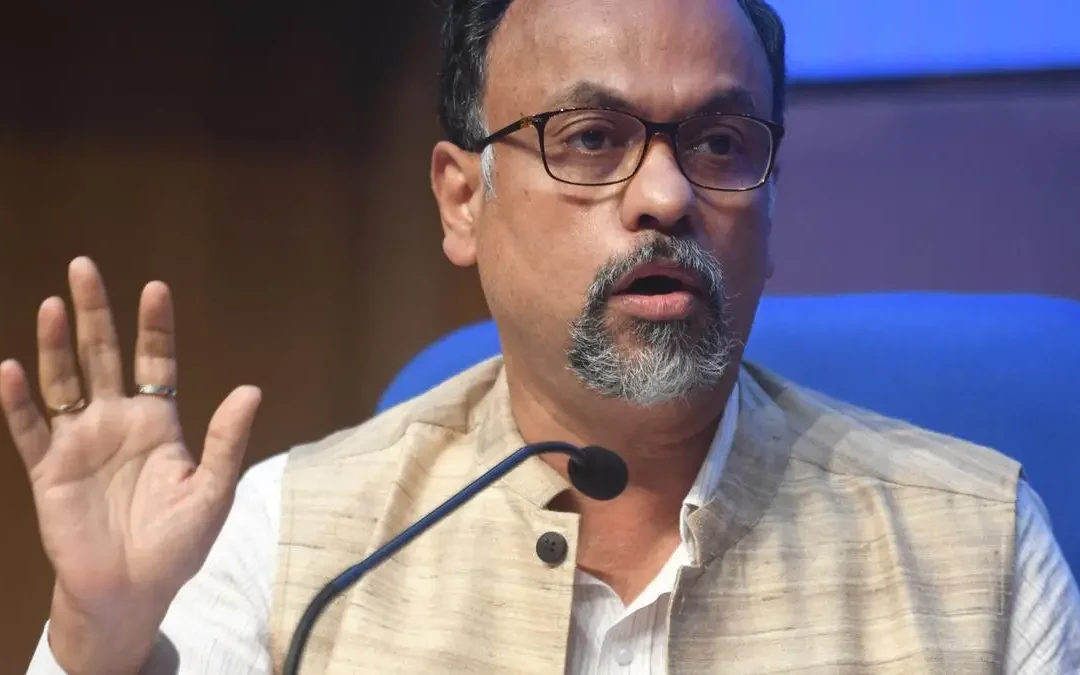

Bring more people into fold of financial inclusion schemes: Fin Services Secy Nagaraju to banks

Nagaraju said that significant progress has been made in expanding social security and deepening financial inclusion in the country through various flagship schemes of the government, and further urged the public and private sector banks to dedicatedly work towards...

FinMin asks banks, insurance firms to expedite public grievances resolution

M Nagaraju, Secretary, Department of Financial services At the outset, the Secretary reiterated the Prime Minister's direction given in the Pragati meeting held on December 26, that all the Senior officers at the level of Chairman/ MD/ ED of PSBs/PSICs should review...

High employee attrition of 25% in private banks pose operational risk: RBI

"High attrition and employee turnover rate pose significant operational risks, including disruption in customer services, besides leading to loss of institutional knowledge and increased recruitment costs. In various interactions with banks, the Reserve Bank has...

Climate change risks impacting financial system, need India-specific data: RBI’s Dy Gov

“Over the last few years, we have taken several incremental measures in this direction. It started with the setting up a dedicated group within the Bank to assess climate change risks and foster a robust ecosystem for sustainable finance,” said Reserve Bank of India...